Metro PCS 2007 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2007 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

80

On August 7, 2006, we acquired a 10 MHz PCS license in the basic trading area of Ocala, Florida in exchange for

a 10 MHz portion of our 30 MHz PCS license in the basic trading area of Athens, Georgia. We paid $0.2 million at

the closing of this agreement.

On November 29, 2006, we were granted AWS licenses as a result of FCC Auction 66, for a total aggregate

purchase price of approximately $1.4 billion. These new licenses cover six of the 25 largest metropolitan areas in the

United States. The east coast expansion opportunities include, but are not limited to, the entire east coast corridor

from Philadelphia to Boston, including New York City, as well as the entire states of New York, New Jersey,

Connecticut and Massachusetts. In the western United States, the new expansion opportunities include the

San Diego, Portland, Seattle and Las Vegas metropolitan areas. The balance supplements or expands the geographic

boundaries of our existing operations in Dallas/Ft. Worth, Detroit, Los Angeles, San Francisco and Sacramento.

Off-Balance Sheet Arrangements

We do not have any off-balance sheet arrangements.

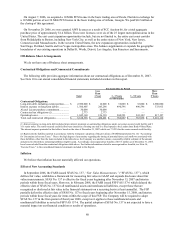

Contractual Obligations and Commercial Commitments

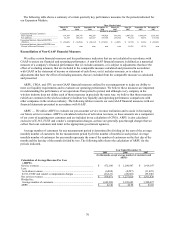

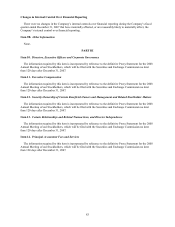

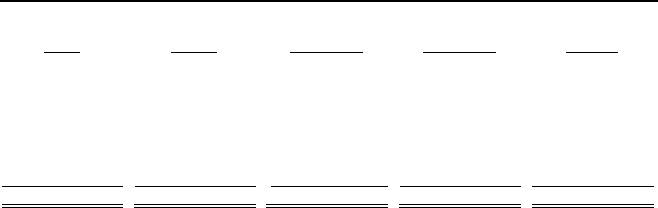

The following table provides aggregate information about our contractual obligations as of December 31, 2007.

See Note 10 to our annual consolidated financial statements included elsewhere in this report.

Payments Due by Period

Total

Less

Than

1 Year

1 - 3 Years

3 - 5 Years

More

Than

5 Years

(In thousands)

Contractual Obligations:

Long-term debt, including current portion........ $ 2,980,000 $ 16,000 $ 32,000 $ 32,000 $ 2,900,000

Interest expense on long-term debt(1) ............... 1,560,405 245,298 490,596 490,596 333,915

Alcatel Lucent purchase commitment............... 30,000 30,000 — — —

Contractual tax obligations (2) .......................... 2,773 2,773 — — —

Operating leases................................................ 1,045,160 126,330 260,291 241,342 417,197

Total cash contractual obligations..................... $ 5,618,338 $ 420,401 $ 782,887 $ 763,938 $ 3,651,112

__________

(1) Interest expense on long-term debt includes future interest payments on outstanding obligations under our senior secured credit facility and 9

¼% senior notes. The senior secured credit facility bears interest at a floating rate tied to a fixed spread to the London Inter Bank Offered Rate.

The interest expense presented in this table is based on the rates at December 31, 2007 which was 7.329% for the senior secured credit facility.

(2) Represents the liability reported in accordance with the Company’ s adoption of the provisions of FASB Interpretation No. 48, “Accounting

for Uncertainty in Income Taxes.” Due to the high degree of uncertainty regarding the timing of potential future cash outflows associated with

these liabilities, other than the items included in the table above, the Company was unable to make a reasonably reliable estimate of the amount

and period in which these remaining liabilities might be paid. Accordingly, unrecognized tax benefits of $19.3 million as of December 31, 2007,

have been excluded from the contractual obligations table above. For further information related to unrecognized tax benefits, see Note 16,

“Income Taxes,” to the consolidated financial statements included in this Report.

Inflation

We believe that inflation has not materially affected our operations.

Effect of New Accounting Standards

In September 2006, the FASB issued SFAS No. 157, “Fair Value Measurements,” (“SFAS No. 157”), which

defines fair value, establishes a framework for measuring fair value in GAAP and expands disclosure about fair

value measurements. SFAS No. 157 is effective for fiscal years beginning after November 15, 2007 and interim

periods within those fiscal years. However, in February 2008, the FASB issued FSP FAS 157-6 which delayed the

effective date of SFAS No. 157 for all nonfinancial assets and nonfinancial liabilities, except those that are

recognized or disclosed at fair value in the financial statements on a recurring basis (at least annually). The FSP

partially defers the effective date of SFAS No. 157 to fiscal years beginning after November 15, 2008, and interim

periods within those fiscal years for items within the scope of this FSP. The Company will be required to adopt

SFAS No. 157 in the first quarter of fiscal year 2008, except as it applies to those nonfinancial assets and

nonfinancial liabilities as noted in FSP FAS 157-6. The partial adoption of SFAS No. 157 is not expected to have a

material impact on our financial condition or results of operations.