Metro PCS 2007 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2007 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

70

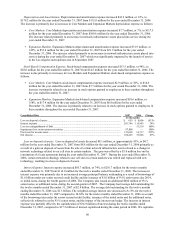

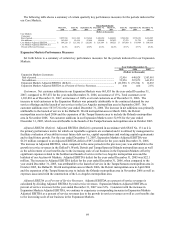

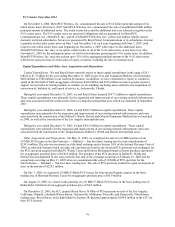

The following table shows a summary of certain quarterly key performance measures for the periods indicated for

our Expansion Markets.

Three Months Ended

March 31,

2006

June 30,

2006

September 30,

2006

December 31,

2006

March 31,

2007

June 30,

2007

September 30,

2007

December 31,

2007

(Dollars in thousands)

Expansion Markets Customers:

End of period ................................................... 114,509 299,741 442,268 640,028 910,392 1,007,626 1,086,199 1,303,881

Net additions.................................................... 61,553 185,232 142,527 197,760 270,364 97,234 78,573 217,682

Expansion Markets Adjusted EBITDA

(Deficit)........................................................... $ (22,685) $ (36,596) $ (20,112

)

$ (17,821) $ (1,005) $ 12,576 $ 13,516 $ (12,205)

Expansion Markets Adjusted EBITDA as a

Percent of Service Revenues .......................... n/m n/m n/m n/m n/m 10.2% 10.3% n/m

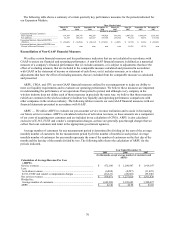

Reconciliation of Non-GAAP Financial Measures

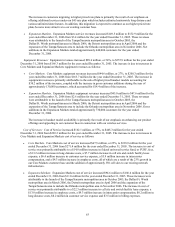

We utilize certain financial measures and key performance indicators that are not calculated in accordance with

GAAP to assess our financial and operating performance. A non-GAAP financial measure is defined as a numerical

measure of a company’ s financial performance that (i) excludes amounts, or is subject to adjustments that have the

effect of excluding amounts, that are included in the comparable measure calculated and presented in accordance

with GAAP in the statement of income or statement of cash flows; or (ii) includes amounts, or is subject to

adjustments that have the effect of including amounts, that are excluded from the comparable measure so calculated

and presented.

ARPU, CPGA, and CPU are non-GAAP financial measures utilized by our management to judge our ability to

meet our liquidity requirements and to evaluate our operating performance. We believe these measures are important

in understanding the performance of our operations from period to period, and although every company in the

wireless industry does not define each of these measures in precisely the same way, we believe that these measures

(which are common in the wireless industry) facilitate key liquidity and operating performance comparisons with

other companies in the wireless industry. The following tables reconcile our non-GAAP financial measures with our

financial statements presented in accordance with GAAP.

ARPU — We utilize ARPU to evaluate our per-customer service revenue realization and to assist in forecasting

our future service revenues. ARPU is calculated exclusive of activation revenues, as these amounts are a component

of our costs of acquiring new customers and are included in our calculation of CPGA. ARPU is also calculated

exclusive of E-911, FUSF and vendor’ s compensation charges, as these are generally pass through charges that we

collect from our customers and remit to the appropriate government agencies.

Average number of customers for any measurement period is determined by dividing (a) the sum of the average

monthly number of customers for the measurement period by (b) the number of months in such period. Average

monthly number of customers for any month represents the sum of the number of customers on the first day of the

month and the last day of the month divided by two. The following table shows the calculation of ARPU for the

periods indicated.

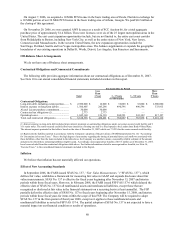

Year Ended December 31,

2005 2006 2007

(In thousands, except average number of customers and

ARPU)

Calculation of Average Revenue Per User

(ARPU):

Service revenues ................................................................................... $ 872,100 $ 1,290,947 $ 1,919,197

Less:

Activation revenues ............................................................................. (6,808) (8,297) (11,425)

E-911, FUSF and vendor’ s compensation charges .............................. (26,221) (45,640) (95,946)

Net service revenues ............................................................................. $ 839,071 $ 1,237,010 $ 1,811,826

Divided by:

Average number of customers ............................................................. 1,649,208 2,398,682 3,508,497

ARPU ................................................................................................... $ 42.40 $ 42.98 $ 43.03