Metro PCS 2007 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2007 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MetroPCS Communications, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

December 31, 2007, 2006 and 2005

F-22

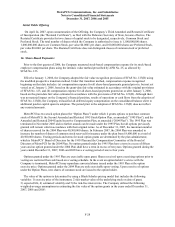

$1.4 Billion 9¼% Senior Notes

On November 3, 2006, Wireless completed the sale of $1.0 billion of principal amount of 9¼% Senior Notes due

2014, (the “Initial Notes”). The net proceeds of the sale of the Initial Notes were approximately $978.0 million after

underwriter fees and other debt issuance costs of $22.0 million. The net proceeds from the sale of the 9¼% Senior

Notes, together with the borrowings under the Senior Secured Credit Facility, were used to repay amounts owed

under the credit agreements, secured bridge credit facility and unsecured bridge credit facility, and to pay related

premiums, fees and expenses, as well as for general corporate purposes. On November 3, 2006, Wireless also

entered into a registration rights agreement. Under the registration rights agreement, Wireless agreed to file a

registration statement with the United States Securities and Exchange Commission (“SEC”) relating to an offer to

exchange and issue notes equal to the outstanding principal amount of the Initial Notes. On May 15, 2007, Wireless

filed such required initial registration statement on Form S-4 (the “Existing Exchange Offer Registration

Statement”).

On June 6, 2007, Wireless completed the sale of an additional $400.0 million of 91/4% Senior Notes (the

“Additional Notes” and together with the Initial Notes, the “9¼% Senior Notes) under the existing indenture at a

price equal to 105.875% of the principal amount of such Additional Notes. On June 6, 2007, Wireless entered into a

registration rights agreement in connection with the consummation of the sale of the Additional Notes. Under the

terms of this registration rights agreement, Wireless agreed to amend the Existing Exchange Offer Registration

Statement within 120 days of the date of the registration rights agreement to include the Additional Notes. On

October 10, 2007, Wireless filed an amendment to the Existing Exchange Offer Registration Statement (“Amended

Exchange Offer Registration Statement”). On October 11, 2007, the SEC declared the Amended Exchange Offer

Registration Statement effective. The exchange offer expired on November 7, 2007, with all the Initial and

Additional Notes being tendered for exchange and the exchange offer was consummated on November 13, 2007.

The 9¼% Senior Notes are unsecured obligations and are guaranteed by MetroPCS, MetroPCS, Inc., and all of

Wireless’ direct and indirect wholly-owned subsidiaries, but are not guaranteed by Royal Street. Interest is payable

on the 9¼% Senior Notes on May 1 and November 1 of each year, beginning on May 1, 2007 for the Initial Notes

and November 1, 2007 for the Additional Notes. Wireless may, at its option, redeem some or all of the 9¼% Senior

Notes at any time on or after November 1, 2010 for the redemption prices set forth in the indenture governing the

9¼% Senior Notes. In addition, Wireless may also redeem up to 35% of the aggregate principal amount of the

9¼% Senior Notes with the net cash proceeds of certain sales of equity securities.

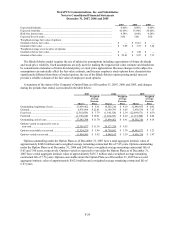

Senior Secured Credit Facility

On November 3, 2006, Wireless entered into the Senior Secured Credit Facility, pursuant to which Wireless may

borrow up to $1.7 billion. The Senior Secured Credit Facility consists of a $1.6 billion term loan facility and a

$100.0 million revolving credit facility. On November 3, 2006, Wireless borrowed $1.6 billion under the Senior

Secured Credit Facility. The term loan facility will be repayable in quarterly installments in annual aggregate

amounts equal to 1% of the initial aggregate principal amount of $1.6 billion. The term loan facility will mature in

seven years and the revolving credit facility will mature in five years. The net proceeds from the borrowings under

the Senior Secured Credit Facility, together with the sale of the Initial Notes, were used to repay amounts owed

under the credit agreements, secured bridge credit facility and unsecured bridge credit facility, and to pay related

premiums, fees and expenses, as well as for general corporate purposes.

The facilities under the Senior Secured Credit Facility are guaranteed by MetroPCS, MetroPCS, Inc. and each of

Wireless’ direct and indirect present and future wholly-owned domestic subsidiaries. The facilities are not

guaranteed by Royal Street, but Wireless pledged the promissory note that Royal Street has given it in connection

with amounts borrowed by Royal Street from Wireless and the limited liability company member interest held in

Royal Street Communications. The Senior Secured Credit Facility contains customary events of default, including

cross defaults. The obligations are also secured by the capital stock of Wireless as well as substantially all of

Wireless’ present and future assets and the capital stock and substantially all of the assets of each of its direct and

indirect present and future wholly-owned subsidiaries (except as prohibited by law and certain permitted

exceptions), but excludes Royal Street.