Metro PCS 2007 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2007 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetroPCS Communications, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

December 31, 2007, 2006 and 2005

F-14

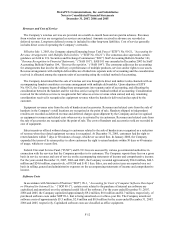

Stock-Based Compensation

Effective January 1, 2006, the Company adopted the fair value recognition provisions of SFAS No. 123(R),

“Share-Based Payment,” (“SFAS No. 123(R)”), which replaces SFAS No. 123, “Accounting for Stock-Based

Compensation,” (“SFAS No. 123”) and supersedes Accounting Principles Board (“APB”) Opinion No. 25,

“Accounting for Stock Issued to Employees,” and its related interpretations (“APB No. 25”). Prior to the first quarter

of 2006, the Company measured stock-based compensation expense for its stock-based employee compensation

plans using the intrinsic value method prescribed by APB No. 25, as allowed by SFAS No. 123. The Company

elected the modified prospective transition method. Under that transition method, compensation expense recognized

beginning on that date includes: (a) compensation expense for all share-based payments granted prior to, but not yet

vested as of, January 1, 2006, based on the grant-date fair value estimated in accordance with the original provisions

of SFAS No. 123, and (b) compensation expense for all share-based payments granted on or after January 1, 2006,

based on the grant-date fair value estimated in accordance with the provisions of SFAS No. 123(R). Although there

was no material impact on the Company’ s financial position, results of operations or cash flows from the adoption of

SFAS No. 123(R), the Company reclassified all deferred equity compensation on the consolidated balance sheet to

additional paid-in capital upon its adoption. The period prior to the adoption of SFAS No. 123(R) does not reflect

any restated amounts.

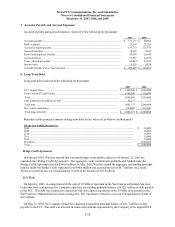

The following table illustrates the effect on net income applicable to common stock (in thousands, except per

share data) and net income per common share as if the Company had elected to recognize compensation costs based

on the fair value at the date of grant for the Company’ s common stock awards consistent with the provisions of

SFAS No. 123 (See Note 14 for assumptions used in the fair value method):

2005

Net income applicable to common stock — as reported................................................ $ 176,065

Add: Amortization of deferred compensation determined under the intrinsic method for

employee stock awards, net of tax............................................................................... 1,584

Less: Total stock-based employee compensation expense determined under the fair value

method for employee stock awards, net of tax ............................................................ (3,227)

Net income applicable to common stock — pro forma ................................................. $ 174,422

Basic net income per common share:

As reported ................................................................................................................... $ 0.71

Pro forma...................................................................................................................... $ 0.70

Diluted net income per common share:

As reported .................................................................................................................... $ 0.62

Pro forma...................................................................................................................... $ 0.62

The pro forma amounts presented above may not be representative of the future effects on reported net income

since the pro forma compensation expense is allocated over the periods in which options become exercisable, and

new option awards may be granted each year.