Metro PCS 2007 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2007 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetroPCS Communications, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

December 31, 2007, 2006 and 2005

F-38

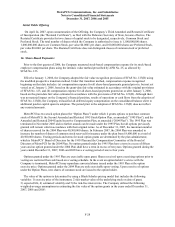

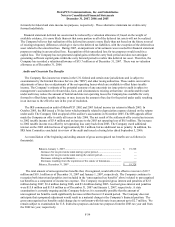

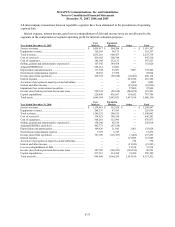

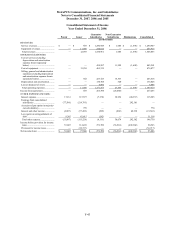

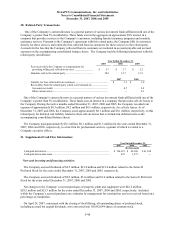

Year Ended December 31, 2005

Core

Markets

Expansion

Markets

Other

Total

Service revenues ........................................................................... $ 868,681 $ 3,419 $ — $ 872,100

Equipment revenues...................................................................... 163,738 2,590 — 166,328

Total revenues............................................................................... 1,032,419 6,009 — 1,038,428

Cost of service .............................................................................. 271,437 11,775 — 283,212

Cost of equipment......................................................................... 293,702 7,169 — 300,871

Selling, general and administrative expenses(2) ........................... 153,321 9,155 — 162,476

Adjusted EBITDA (deficit)(3)...................................................... 316,555 (22,090) —

Depreciation and amortization...................................................... 84,436 2,030 1,429 87,895

Stock-based compensation expense.............................................. 2,596 — — 2,596

Income (loss) from operations ...................................................... 219,777 (24,370) 226,770 422,177

Interest expense ............................................................................ — — 58,033 58,033

Accretion of put option in majority-owned subsidiary.................. — — 252 252

Interest and other income.............................................................. — — (8,658) (8,658)

Loss on extinguishment of debt .................................................... — — 46,448 46,448

Income (loss) before provision for income taxes.......................... 219,777 (24,370) 130,695 326,102

Capital expenditures ..................................................................... 171,783 90,871 3,845 266,499

Total assets ................................................................................... 701,675 378,671 1,078,635 2,158,981

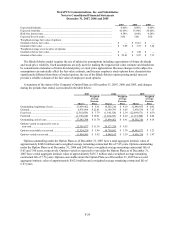

__________

(1) Cost of service for the years ended December 31, 2007 and 2006 includes $1.8 million and $1.3 million, respectively, of stock-based

compensation expense disclosed separately.

(2) Selling, general and administrative expenses include stock-based compensation expense disclosed separately. For the years ended

December 31, 2007, 2006 and 2005, selling, general and administrative expenses include $26.2 million, $13.2 million and $2.6 million,

respectively, of stock-based compensation expense.

(3) Adjusted EBITDA (deficit) is presented in accordance with SFAS No. 131 as it is the primary financial measure utilized by management

to facilitate evaluation of each segments’ ability to meet future debt service, capital expenditures and working capital requirements and to

fund future growth.

(4) Total assets as of December 31, 2006 include the Auction 66 AWS licenses that the Company was granted on November 29, 2006 for a

total aggregate purchase price of approximately $1.4 billion. These AWS licenses are presented in the “Other” column as the Company

had not allocated the Auction 66 licenses to its reportable segments as of December 31, 2006. As of December 31, 2007, the Auction 66

AWS licenses are included in Expansion Markets total assets.

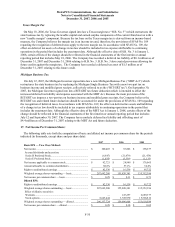

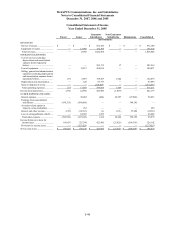

The following table reconciles segment Adjusted EBITDA (Deficit) for the years ended December 31, 2007,

2006 and 2005 to consolidated income before provision for income taxes:

2007 2006 2005

Segment Adjusted EBITDA (Deficit):

Core Markets Adjusted EBITDA................................................................................. $ 654,112 $ 492,773 $ 316,555

Expansion Markets Adjusted EBITDA (Deficit) ......................................................... 12,883 (97,214) (22,090)

Total............................................................................................................................ 666,995 395,559 294,465

Depreciation and amortization..................................................................................... (178,202) (135,028) (87,895)

(Loss) gain on disposal of assets.................................................................................. (655) (8,806) 218,203

Non-cash compensation expense ................................................................................. (28,024) (14,472) (2,596)

Interest expense ........................................................................................................... (201,746) (115,985) (58,033)

Accretion of put option in majority-owned subsidiary................................................. (1,003) (770) (252)

Interest and other income............................................................................................. 63,936 21,543 8,658

Impairment loss on investment securities .................................................................... (97,800) — —

Loss on extinguishment of debt ................................................................................... — (51,518) (46,448)

Consolidated income before provision for income taxes......................................... $ 223,501 $ 90,523 $ 326,102

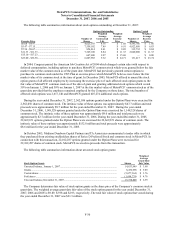

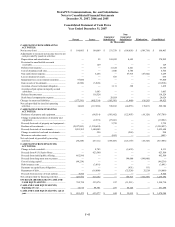

19. Guarantor Subsidiaries:

In connection with Wireless’ sale of the 91/4% Senior Notes and the entry into the Senior Secured Credit Facility,

MetroPCS and all of MetroPCS’ subsidiaries, other than Wireless and Royal Street (the “guarantor subsidiaries”),

provided guarantees on the 91/4% Senior Notes and Senior Secured Credit Facility. These guarantees are full and

unconditional as well as joint and several. Certain provisions of the Senior Secured Credit Facility and the indenture

relating to the 9¼% Senior Notes restrict the ability of Wireless to loan funds to MetroPCS. However, Wireless is

allowed to make certain permitted payments to MetroPCS under the terms of the Senior Secured Credit Facility and