Metro PCS 2007 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2007 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

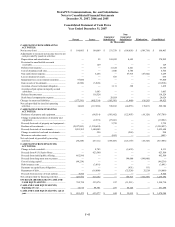

MetroPCS Communications, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

December 31, 2007, 2006 and 2005

F-41

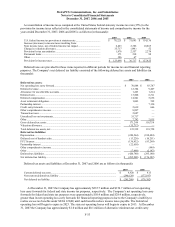

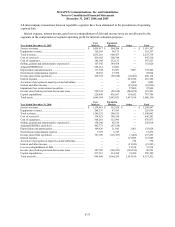

Consolidated Balance Sheet

As of December 31, 2006

Parent

Issuer

Guarantor

Subsidiaries

Non-

Guarantor

Subsidiaries

Eliminations

Consolidated

(In thousands)

CURRENT ASSETS:

Cash and cash equivalents................. $ 15,714 $ 99,301 $ 257 $ 46,226 $ — $ 161,498

Short-term investments ..................... 45,365 345,286 — — — 390,651

Restricted short-term investments..... — 556 — 51 — 607

Inventories, net .................................. — 81,339 11,576 — — 92,915

Accounts receivable, net ................... — 29,348 — 1,005 (2,213) 28,140

Prepaid charges ................................. — 8,107 23,865 1,137 — 33,109

Deferred charges ............................... — 26,509 — — — 26,509

Deferred tax asset .............................. — 815 — — — 815

Current receivable from

subsidiaries...................................... — 4,734 — — (4,734) —

Other current assets ........................... 97 9,478 15,354 120 (766) 24,283

Total current assets........................... 61,176 605,473 51,052 48,539 (7,713) 758,527

Property and equipment, net ............. — 14,077 1,158,442 83,643 — 1,256,162

Long-term investments...................... — 1,865 — — — 1,865

Investment in subsidiaries................. 320,783 939,009 — — (1,259,792) —

FCC licenses...................................... 1,391,410 — 387,876 293,599 — 2,072,885

Microwave relocation costs............... — — 9,187 — — 9,187

Long-term receivable from

subsidiaries...................................... — 456,070 — — (456,070) —

Other assets........................................ 399 51,477 4,078 5,810 (7,268) 54,496

Total assets ....................................... $ 1,773,768 $ 2,067,971 $ 1,610,635 $ 431,591 $ (1,730,843) $ 4,153,122

CURRENT LIABILITIES:

Accounts payable and accrued

expenses .......................................... $ 401 $ 138,953 $ 161,663 $ 29,614 $ (4,950) $ 325,681

Current maturities of long-term

debt.................................................. — 16,000 — 4,734 (4,734) 16,000

Deferred revenue............................... — 19,030 71,471 — — 90,501

Advances to subsidiaries ................... 865,612 (1,207,821) 341,950 — 259 —

Other current liabilities ..................... — 31 3,416 757 (757) 3,447

Total current liabilities ..................... 866,013 (1,033,807) 578,500 35,105 (10,182) 435,629

Long-term debt.................................. — 2,580,000 — 4,540 (4,540) 2,580,000

Long-term note to parent................... — — — 456,070 (456,070) —

Deferred tax liabilities....................... 7 177,190 — — — 177,197

Deferred rents.................................... — — 21,784 419 — 22,203

Redeemable minority interest ........... — 4,029 — — — 4,029

Other long-term liabilities ................. — 19,517 6,285 514 — 26,316

Total liabilities ................................. 866,020 1,746,929 606,569 496,648 (470,792) 3,245,374

COMMITMENTS AND

CONTINGENCIES (See

Note 10)

SERIES D PREFERRED STOCK ..... 443,368 — — — — 443,368

SERIES E PREFERRED STOCK ..... 51,135 — — — — 51,135

STOCKHOLDERS’ EQUITY:

Preferred stock................................... — — — — — —

Common stock................................... 16 — — — — 16

Additional paid-in capital.................. 166,315 — — 20,000 (20,000) 166,315

Retained earnings (deficit) ................ 245,690 319,863 1,004,066 (85,057) (1,238,872) 245,690

Accumulated other comprehensive

income............................................. 1,224 1,179 — — (1,179) 1,224

Total stockholders’ equity................ 413,245 321,042 1,004,066 (65,057) (1,260,051) 413,245

Total liabilities and stockholders’

equity ............................................. $ 1,773,768 $ 2,067,971 $ 1,610,635 $ 431,591 $ (1,730,843) $ 4,153,122