Metro PCS 2007 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2007 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

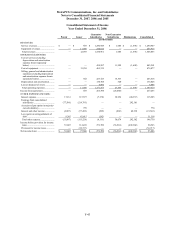

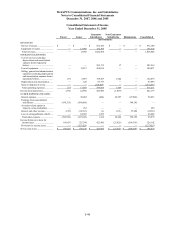

MetroPCS Communications, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

December 31, 2007, 2006 and 2005

F-34

forwards for federal and state income tax purposes, respectively. These alternative minimum tax credits carry

forward indefinitely.

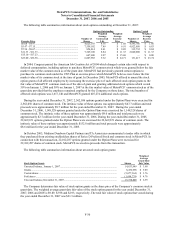

Financial statement deferred tax assets must be reduced by a valuation allowance if, based on the weight of

available evidence, it is more likely than not that some portion or all of the deferred tax assets will not be realized.

The Company believes that realization of the deferred tax assets is more likely than not based on the future reversal

of existing temporary differences which give rise to the deferred tax liabilities, with the exception of the deferred tax

asset related to the unrealized loss. During 2007, an impairment of investments was recorded for financial statement

purposes resulting in an unrealized loss. Recognition of this unrealized loss for tax purposes would result in a

capital loss. The Company has not generated capital gains within the carry back period and does not anticipate

generating sufficient capital gains within the carry forward period to realize this deferred tax asset. Therefore, the

Company has recorded a valuation allowance of $35.7 million as of December 31, 2007. There was no valuation

allowance as of December 31, 2006.

Audits and Uncertain Tax Benefits

The Company files income tax returns in the U.S. federal and certain state jurisdictions and is subject to

examinations by the Internal Revenue Service (the “IRS”) and other taxing authorities. These audits can result in

adjustments of taxes due or adjustments of the net operating losses which are available to offset future taxable

income. The Company’ s estimate of the potential outcome of any uncertain tax issue prior to audit is subject to

management’ s assessment of relevant risks, facts, and circumstances existing at that time. An unfavorable result

under audit may reduce the amount of federal and state net operating losses the Company has available for carry

forward to offset future taxable income, or may increase the amount of tax due for the period under audit, resulting

in an increase to the effective rate in the year of resolution.

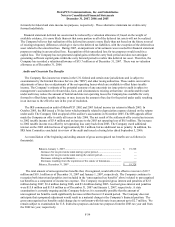

The IRS commenced an audit of MetroPCS’ 2002 and 2003 federal income tax returns in March 2005. In

October 2005, the IRS issued a 30 day letter which primarily related to depreciation expense claimed on the returns

under audit. The Company filed an appeal of the auditor’ s assessments in November 2005. The IRS appeals officer

made the Company an offer to settle all issues in July 2006. The net result of the settlement offer created an increase

to 2002 taxable income of $3.9 million and an increase to the 2003 net operating loss of $0.5 million. The increase

to 2002 taxable income was offset by net operating loss carry back from 2003. The Company owed additional

interest on the 2002 deferred taxes of approximately $0.1 million, but no additional tax or penalty. In addition, the

IRS Joint Committee concluded its review of the audit and issued a closing letter dated September 5, 2006.

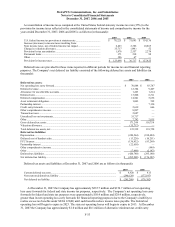

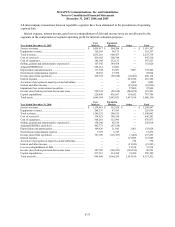

A reconciliation of the beginning and ending amount of gross unrecognized tax benefits are as follows (in

thousands):

Balance, January 1, 2007 ..................................................................................... $ 19,328

Increases for tax provisions taken during a prior period .................................... —

Increases for tax provisions taken during the current period.............................. —

Decreases relating to settlements ....................................................................... —

Decreases resulting from the expiration of the statute of limitations ................. —

Balance, December 31, 2007 ............................................................................... $ 19,328

The total amount of unrecognized tax benefits that, if recognized, would affect the effective tax rate is $19.7

million and $18.1 million as of December 31, 2007 and January 1, 2007, respectively. The Company continues to

recognize both interest and penalties (not included in the “unrecognized tax benefits” above) related to unrecognized

tax benefits as a component of income tax expense. The Company recognized gross interest and penalties of $2.8

million during 2007, $3.4 million during 2006, and $3.4 million during 2005. Accrued gross interest and penalties

were $15.8 million and $13.0 million as of December 31, 2007 and January 1, 2007, respectively. A state

examination is currently ongoing and the Company believes it is reasonably possible that the amount of

unrecognized tax benefits could significantly decrease within the next 12 month period. The Company does not

anticipate that a proposed adjustment would result in a material change to the Company’ s financial position. The

gross unrecognized tax benefits could change due to settlement with this state in an amount up to $2.7 million. We

remain subject to examination for U.S. federal tax purposes and state tax purposes from the 2003 tax year and from

the 2002 tax year, respectively.