Metro PCS 2007 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2007 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetroPCS Communications, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

December 31, 2007, 2006 and 2005

F-23

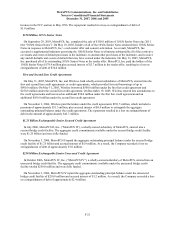

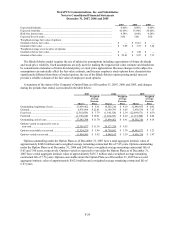

The interest rate on the outstanding debt under the Senior Secured Credit Facility is variable. The rate as of

December 31, 2007 was 7.329%. On November 21, 2006, Wireless entered into a three-year interest rate protection

agreement to manage the Company’ s interest rate risk exposure and fulfill a requirement of the Senior Secured

Credit Facility. The agreement covers a notional amount of $1.0 billion and effectively converts this portion of

Wireless’ variable rate debt to fixed-rate debt (See Note 5). On February 20, 2007, Wireless entered into an

amendment to the Senior Secured Credit Facility. Under the amendment, the margin on the base rate used to

determine the Senior Secured Credit Facility interest rate was reduced to 2.25% from 2.50%.

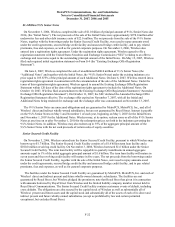

Restructuring

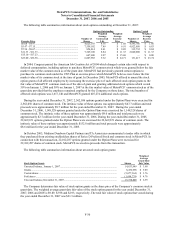

On November 3, 2006, in connection with the closing of the Initial Notes, the entry into the Senior Secured Credit

Facility and the repayment of all amounts outstanding under the credit agreements, the secured bridge credit facility

and the unsecured bridge credit facility, the Company consummated a restructuring transaction. As a result of the

restructuring transaction, Wireless became a wholly-owned direct subsidiary of MetroPCS, Inc. (formerly

MetroPCS V, Inc.), which is a wholly-owned direct subsidiary of MetroPCS. MetroPCS and MetroPCS, Inc., along

with each of Wireless’ wholly-owned subsidiaries (which excludes Royal Street), guarantee the 9¼% Senior Notes

and the obligations under the Senior Secured Credit Facility. MetroPCS, Inc. pledged the capital stock of Wireless

as security for the obligations under the Senior Secured Credit Facility. All of the Company’ s FCC licenses and the

Company’ s interest in Royal Street are held by Wireless and its wholly-owned subsidiaries.

9. Concentrations:

The Company purchases a substantial portion of its wireless infrastructure equipment and handset equipment

from only a few major suppliers. Further, the Company generally relies on one key vendor in each of the following

areas: network infrastructure equipment, billing services, customer care, handset logistics and long distance services.

Loss of any of these suppliers could adversely affect operations temporarily until a comparable substitute could be

found. Verisign, the Company’ s existing billing system provider, has publicly announced that it plans to leave the

telecommunications services business, including the billing services business. The Company is in the process of

identifying and negotiating a new billing service agreement with another nationally recognized third-party vendor.

Local and long distance telephone and other companies provide certain communication services to the Company.

Disruption of these services could adversely affect operations in the short term until an alternative

telecommunication provider was found.

Concentrations of credit risk with respect to trade accounts receivable are limited due to the diversity of the

Company’ s indirect retailer base.

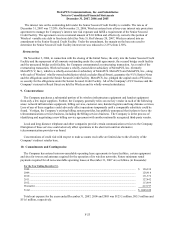

10. Commitments and Contingencies:

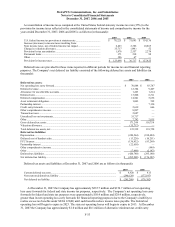

The Company has entered into non-cancelable operating lease agreements to lease facilities, certain equipment

and sites for towers and antennas required for the operation of its wireless networks. Future minimum rental

payments required for all non-cancelable operating leases at December 31, 2007 are as follows (in thousands):

For the Year Ending December 31,

2008................................................................................................................................................................... $ 126,330

2009................................................................................................................................................................... 128,918

2010................................................................................................................................................................... 131,374

2011................................................................................................................................................................... 127,442

2012................................................................................................................................................................... 113,899

Thereafter .......................................................................................................................................................... 417,197

Total .................................................................................................................................................................. $ 1,045,160

Total rent expense for the years ended December 31, 2007, 2006 and 2005 was $125.1 million, $85.5 million and

$51.6 million, respectively.