Metro PCS 2007 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2007 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetroPCS Communications, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

December 31, 2007, 2006 and 2005

F-20

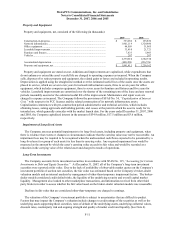

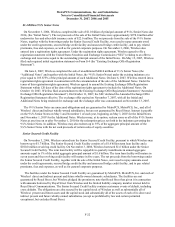

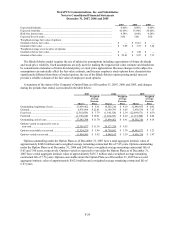

7. Accounts Payable and Accrued Expenses:

Accounts payable and accrued expenses consisted of the following (in thousands):

2007 2006

Accounts payable ....................................................................................................................... $ 131,177 $ 90,084

Book overdraft............................................................................................................................ 25,399 21,288

Accrued accounts payable .......................................................................................................... 155,733 111,974

Accrued liabilities....................................................................................................................... 16,285 9,405

Payroll and employee benefits.................................................................................................... 29,380 20,645

Accrued interest.......................................................................................................................... 33,892 24,529

Taxes, other than income............................................................................................................ 41,044 42,882

Income taxes............................................................................................................................... 6,539 4,874

Accounts payable and accrued expenses .................................................................................... $ 439,449 $ 325,681

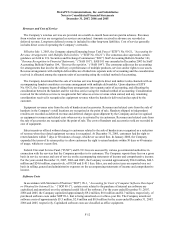

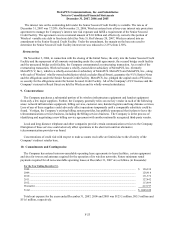

8. Long-Term Debt:

Long-term debt consisted of the following (in thousands):

2007 2006

9¼% Senior Notes.................................................................................................................. $ 1,400,000 $ 1,000,000

Senior Secured Credit Facility................................................................................................ 1,580,000 1,596,000

Total ...................................................................................................................................... 2,980,000 2,596,000

Add: unamortized premium on debt ....................................................................................... 22,177 —

Total debt............................................................................................................................... 3,002,177 2,596,000

Less: current maturities .......................................................................................................... (16,000) (16,000)

Total long-term debt.............................................................................................................. $ 2,986,177 $ 2,580,000

Maturities of the principal amount of long-term debt at face value are as follows (in thousands):

For the Year Ending December 31,

2008................................................................................................................................................................ $ 16,000

2009................................................................................................................................................................ 16,000

2010................................................................................................................................................................ 16,000

2011................................................................................................................................................................ 16,000

2012................................................................................................................................................................ 16,000

Thereafter ....................................................................................................................................................... 2,900,000

Total ............................................................................................................................................................... $ 2,980,000

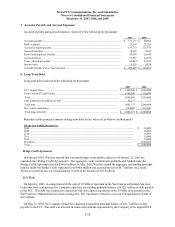

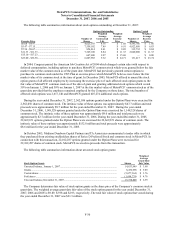

Bridge Credit Agreement

In February 2005, Wireless entered into a secured bridge credit facility, dated as of February 22, 2005 (as

amended, the “Bridge Credit Agreement”). The aggregate credit commitments available and funded under the

Bridge Credit Agreement totaled $540.0 million. In May 2005, Wireless repaid the aggregate outstanding principal

balance under the Bridge Credit Agreement of $540.0 million and accrued interest of $8.7 million. As a result,

Wireless recorded a loss on extinguishment of debt in the amount of $10.4 million.

FCC Debt

On March 2, 2005, in connection with the sale of 10 MHz of spectrum in the San Francisco-Oakland-San Jose,

California basic trading area, the Company repaid the outstanding principal balance of $12.2 million in debt payable

to the FCC. This debt was incurred in connection with the original acquisition of the 30 MHz of spectrum for the

San Francisco-Oakland-San Jose basic trading area. The repayment resulted in a loss on extinguishment of debt of

$0.9 million.

On May 31, 2005, the Company repaid the remaining outstanding principal balance of $15.7 million in debt

payable to the FCC. This debt was incurred in connection with the acquisition by the Company of its original PCS