Metro PCS 2007 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2007 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetroPCS Communications, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

December 31, 2007, 2006 and 2005

F-15

Asset Retirement Obligations

The Company accounts for asset retirement obligations as determined by SFAS No. 143, “Accounting for Asset

Retirement Obligations,” (“SFAS No. 143”) and FASB Interpretation No. 47, “Accounting for Conditional Asset

Retirement Obligations, an interpretation of FASB Statement No. 143,” (“FIN No. 47”). SFAS No. 143 and

FIN No. 47 address financial accounting and reporting for legal obligations associated with the retirement of

tangible long-lived assets and the related asset retirement costs. SFAS No. 143 requires that companies recognize

the fair value of a liability for an asset retirement obligation in the period in which it is incurred. When the liability

is initially recorded, the entity capitalizes a cost by increasing the carrying amount of the related long-lived asset.

Over time, the liability is accreted to its present value each period, and the capitalized cost is depreciated over the

estimated useful life of the related asset. Upon settlement of the liability, an entity either settles the obligation for its

recorded amount or incurs a gain or loss upon settlement.

The Company is subject to asset retirement obligations associated with its cell site operating leases, which are

subject to the provisions of SFAS No. 143 and FIN No. 47. Cell site lease agreements may contain clauses requiring

restoration of the leased site at the end of the lease term to its original condition, creating an asset retirement

obligation. This liability is classified under other long-term liabilities. Landlords may choose not to exercise these

rights as cell sites are considered useful improvements. In addition to cell site operating leases, the Company has

leases related to switch site, retail, and administrative locations subject to the provisions of SFAS No. 143 and

FIN No. 47.

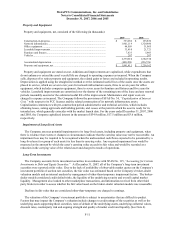

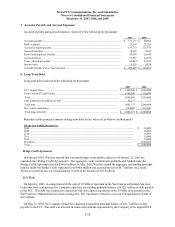

The following table summarizes the Company’ s asset retirement obligation transactions (in thousands):

2007 2006

Beginning asset retirement obligations................................................................................ $ 6,685 $ 3,522

Liabilities incurred .............................................................................................................. 6,929 2,394

Reductions........................................................................................................................... (755)

—

Accretion expense ............................................................................................................... 1,439 769

Ending asset retirement obligations..................................................................................... $ 14,298 $ 6,685

Earnings Per Share

Basic earnings per share (“EPS”) are based upon the weighted average number of common shares outstanding for

the period. Diluted EPS is computed in the same manner as EPS after assuming issuance of common stock for all

potentially dilutive equivalent shares, whether exercisable or not.

The Series D Preferred Stock and Series E Preferred Stock (collectively, the “preferred stock”) are participating

securities, such that in the event a dividend is declared or paid on the common stock, the Company must

simultaneously declare and pay a dividend on the preferred stock as if they had been converted into common stock.

In accordance with EITF Issue 03-6, “Participating Securities and the Two-Class Method under FASB Statement

No. 128,” (“EITF 03-6”), the preferred stock is considered a “participating security” for purposes of computing

earnings or loss per common share and, therefore, the preferred stock is included in the computation of basic and

diluted earnings per common share using the two-class method, except during periods of net losses. When

determining basic earnings per common share under EITF 03-6, undistributed earnings for a period are allocated to a

participating security based on the contractual participation rights of the security to share in those earnings as if all

of the earnings for the period had been distributed (See Note 17).

Recent Accounting Pronouncements

In September 2006, the FASB issued SFAS No. 157, “Fair Value Measurements,” (“SFAS No. 157”), which

defines fair value, establishes a framework for measuring fair value in GAAP and expands disclosure about fair

value measurements. SFAS No. 157 is effective for fiscal years beginning after November 15, 2007 and interim

periods within those fiscal years. However, in February 2008, the FASB issued FSP FAS 157-6 which delayed the

effective date of SFAS No. 157 for all nonfinancial assets and nonfinancial liabilities, except those that are

recognized or disclosed at fair value in the financial statements on a recurring basis (at least annually). The FSP

partially defers the effective date of SFAS No. 157 to fiscal years beginning after November 15, 2008, and interim