Metro PCS 2007 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2007 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

68

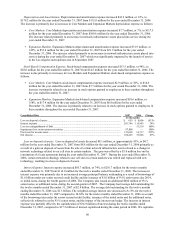

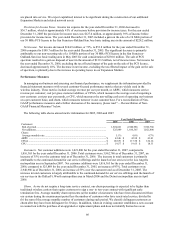

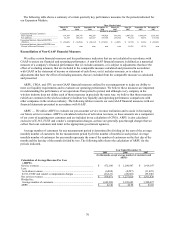

The following table shows quarterly metric information for the years ended December 31, 2006 and 2007.

Three Months Ended

March 31,

2006

June 30,

2006

September 30,

2006

December 31,

2006

March 31,

2007

June 30,

2007

September 30,

2007

December 31,

2007

Customers:..............

End of period .......... 2,170,059 2,418,909 2,616,532 2,940,986 3,395,203 3,549,916 3,664,218 3,962,786

Net additions........... 245,437 248,850 197,623 324,454 454,217 154,713 114,302 298,568

Churn(1): ................

Average monthly

rate ....................... 4.4% 4.5% 5.0% 4.5% 4.0% 4.8% 5.2% 4.8%

ARPU ..................... $ 43.12 $ 42.86 $ 42.78 $ 43.15 $ 43.75 $ 43.18 $ 42.77 $ 42.54

CPGA(1)................. $ 106.26 $ 122.20 $ 120.29 $ 120.01 $ 108.80 $ 124.79 $ 125.92 $ 137.51

CPU ........................ $ 20.11 $ 19.78 $ 19.15 $ 19.67 $ 18.56 $ 18.01 $ 17.81 $ 18.93

__________

(1) On January 23, 2006, we revised the terms of our return policy from 7 days to 30 days, and as a result we revised our definition of gross

customer additions to exclude customers that discontinue service in the first 30 days of service. This revision, commencing March 23, 2006,

reduces deactivations and gross customer additions, which reduces churn and increases CPGA.

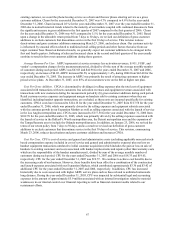

Core Markets Performance Measures

Set forth below is a summary of certain key performance measures for the periods indicated for our Core

Markets:

Year Ended December 31,

2005 2006 2007

(Dollars in thousands)

Core Markets Customers:

End of period ..........................................................................................................

.

1,871,665 2,300,958 2,658,905

Net additions...........................................................................................................

.

472,933 429,293 357,947

Core Markets Adjusted EBITDA.............................................................................

.

$ 316,555 $ 492,773 $ 654,112

Core Markets Adjusted EBITDA as a Percent of Service Revenues .......................

.

36.4% 43.3% 46.2%

We launched our service initially in 2002 in the greater Miami, Atlanta, Sacramento and San Francisco

metropolitan areas. Our Core Markets have a licensed population of approximately 26 million, of which our

networks currently cover approximately 24 million. In addition, we had positive adjusted earnings before interest,

taxes, depreciation and amortization, gain/loss on disposal of assets, accretion of put option in majority-owned

subsidiary, gain/loss on extinguishment of debt, cumulative effect of change in accounting principle and non-cash

stock-based compensation, or Adjusted EBITDA, in our Core Markets after only four full quarters of operations.

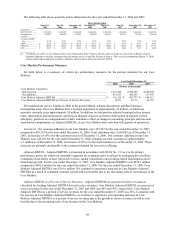

Customers. Net customer additions in our Core Markets were 357,947 for the year ended December 31, 2007,

compared to 429,293 for the year ended December 31, 2006. Total customers were 2,658,905 as of December 31,

2007, an increase of 16% over the customer total as of December 31, 2006. Net customer additions in our Core

Markets were 429,293 for the year ended December 31, 2006, bringing our total customers to approximately

2.3 million as of December 31, 2006, an increase of 23% over the total customers as of December 31, 2005. These

increases are primarily attributable to the continued demand for our service offering.

Adjusted EBITDA. Adjusted EBITDA is presented in accordance with SFAS No. 131 as it is the primary

performance metric for which our reportable segments are evaluated and it is utilized by management to facilitate

evaluation of our ability to meet future debt service, capital expenditures and working capital requirements and to

fund future growth. For the year ended December 31, 2007, Core Markets Adjusted EBITDA was $654.1 million

compared to $492.8 million for the year ended December 31, 2006. For the year ended December 31, 2005, Core

Markets Adjusted EBITDA was $316.6 million. We continue to experience increases in Core Markets Adjusted

EBITDA as a result of continued customer growth and cost benefits due to the increasing scale of our business in the

Core Markets.

Adjusted EBITDA as a Percent of Service Revenues. Adjusted EBITDA as a percent of service revenues is

calculated by dividing Adjusted EBITDA by total service revenues. Core Markets Adjusted EBITDA as a percent of

service revenues for the year ended December 31, 2007 and 2006 was 46% and 43%, respectively. Core Markets

Adjusted EBITDA as a percent of service revenues for the year ended December 31, 2005 was 36%. Consistent with

the increase in Core Markets Adjusted EBITDA, we continue to experience corresponding increases in Core

Markets Adjusted EBITDA as a percent of service revenues due to the growth in service revenues as well as cost

benefits due to the increasing scale of our business in the Core Markets.