Metro PCS 2007 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2007 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MetroPCS Communications, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

December 31, 2007, 2006 and 2005

F-16

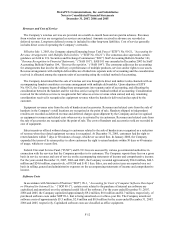

periods within those fiscal years for items within the scope of this FSP. The Company will be required to adopt

SFAS No. 157 in the first quarter of fiscal year 2008, except as it applies to those nonfinancial assets and

nonfinancial liabilities as noted in FSP FAS 157-6. The partial adoption of SFAS No. 157 is not expected to have a

material impact on the Company’ s financial condition or results of operations.

In February 2007, the FASB issued SFAS No. 159, “The Fair Value Option for Financial Assets and Financial

Liabilities — Including an amendment of FASB Statement No. 115,” (“SFAS No. 159”), which permits entities to

choose to measure many financial instruments and certain other items at fair value. The objective of SFAS No. 159

is to improve financial reporting by providing entities with the opportunity to mitigate volatility in reported earnings

caused by measuring related assets and liabilities differently without having to apply complex hedge accounting

provisions. SFAS No. 159 is effective for fiscal years beginning after November 15, 2007. The Company was

required to adopt SFAS No. 159 on January 1, 2008. The adoption of SFAS No. 159 did not have a material impact

on the Company’ s financial condition or results of operations.

In December 2007, the FASB issued SFAS No. 141(R), “Business Combinations,” (“SFAS No. 141(R)”), which

establishes principles and requirements for how an acquirer recognizes and measures in its financial statements the

identifiable assets acquired, the liabilities assumed, any noncontrolling interest in the acquiree and the goodwill

acquired. SFAS No. 141(R) also establishes disclosure requirements to enable the evaluation of the nature and

financial effects of the business combination. SFAS No. 141(R) is effective for financial statements issued for fiscal

years beginning after December 15, 2008 and early adoption is prohibited. The Company has not yet determined the

effect on its financial condition or results of operations, if any, upon adoption of SFAS No. 141(R).

In December 2007, the FASB issued SFAS No. 160, “Noncontrolling Interests in Consolidated Financial

Statements,” (“SFAS No. 160”), which establishes accounting and reporting standards for ownership interests in

subsidiaries held by parties other than the parent, the amount of consolidated net income attributable to the parent

and to the noncontrolling interest, changes in a parent’ s ownership interest, and the valuation of retained

noncontrolling equity investments when a subsidiary is deconsolidated. SFAS No. 160 also establishes disclosure

requirements that clearly identify and distinguish between the interests of the parent and the interests of the

noncontrolling owners. SFAS No. 160 is effective for financial statements issued for fiscal years beginning after

December 15, 2008 and early adoption is prohibited. The Company has not yet determined the effect on its financial

condition or results of operations, if any, upon adoption of SFAS No. 160.

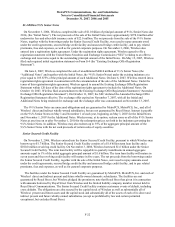

3. Majority-Owned Subsidiary:

On November 24, 2004, MetroPCS, through its wholly-owned subsidiaries, together with C9 Wireless, LLC, an

independent, unaffiliated third-party, formed a limited liability company, Royal Street Communications, that

qualified to bid for closed licenses and to receive bidding credits as a very small business DE on open licenses in

FCC Auction No. 58. MetroPCS indirectly owns 85% of the limited liability company member interest of Royal

Street Communications, but may elect only two of five members of the Royal Street Communications’ management

committee, which has the full power to direct the management of Royal Street. Royal Street Communications has

formed limited liability company subsidiaries which hold all licenses won in Auction No. 58. At Royal Street

Communications’ request and subject to Royal Street Communications’ control and direction, MetroPCS is assisting

in the construction of Royal Street’ s networks and has agreed to purchase, via a resale arrangement, as much as 85%

of the engineered service capacity of Royal Street’ s networks. The Company’ s consolidated financial statements

include the balances and results of operations of MetroPCS and its wholly-owned subsidiaries as well as the

balances and results of operations of Royal Street. The Company consolidates its interest in Royal Street in

accordance with FIN 46(R). Royal Street qualifies as a variable interest entity under FIN 46(R) because the

Company is the primary beneficiary of Royal Street and will absorb all of Royal Street’ s expected losses. Royal

Street does not guarantee MetroPCS Wireless, Inc.’ s (“Wireless”) obligations under its senior secured credit facility,

pursuant to which Wireless may borrow up to $1.7 billion, as amended, (the “Senior Secured Credit Facility”) and

its $1.4 billion of 9¼% Senior Notes due 2014 (the “9¼% Senior Notes”). See the “non-guarantor subsidiaries”

information in Note 19 for the financial position and results of operations of Royal Street. C9 Wireless, LLC, a

beneficial interest holder in Royal Street, has no recourse to the general credit of MetroPCS. All intercompany

accounts and transactions between the Company and Royal Street have been eliminated in the consolidated financial

statements.