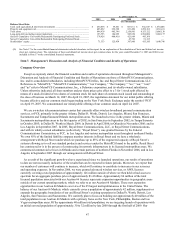

Metro PCS 2007 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2007 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.52

Share-Based Payments

We account for share-based awards exchanged for employee services in accordance with SFAS No. 123(R),

“Share-Based Payment,” (“SFAS No. 123(R)”). Under SFAS No. 123(R), share-based compensation cost is

measured at the grant date, based on the estimated fair value of the award, and is recognized as expense over the

employee’ s requisite service period. We adopted SFAS No. 123(R) on January 1, 2006. Prior to 2006, we

recognized stock-based compensation expense for employee share-based awards based on their intrinsic value on the

date of grant pursuant to Accounting Principles Board (“APB”) Opinion No. 25, “Accounting for Stock Issued to

Employees,” (“APB No. 25”) and followed the disclosure requirements of SFAS No. 148, “Accounting for Stock-

Based Compensation — Transition and Disclosure,” (“SFAS No. 148”), which amends the disclosure requirements

of SFAS No. 123, “Accounting for Stock-Based Compensation,” (“SFAS No. 123”).

We adopted SFAS No. 123(R) using the modified prospective transition method. Under the modified prospective

transition method, prior periods are not revised for comparative purposes. The valuation provisions of

SFAS No. 123(R) apply to new awards and to awards that are outstanding on the effective date and subsequently

modified or cancelled. Compensation expense, net of estimated forfeitures, for awards outstanding at the effective

date is recognized over the remaining service period using the compensation cost calculated under SFAS No. 123 in

prior periods.

We have granted nonqualified stock options. Most of our stock option awards include a service condition that

relates only to vesting. The stock option awards generally vest in one to four years from the grant date.

Compensation expense is amortized on a straight-line basis over the requisite service period for the entire award,

which is generally the maximum vesting period of the award.

The determination of the fair value of stock options using an option-pricing model is affected by our common

stock valuation as well as assumptions regarding a number of complex and subjective variables. The methods used

to determine these variables are generally similar to the methods used prior to 2006 for purposes of our pro forma

information under SFAS No. 148. Prior to our initial public offering, factors that our Board of Directors considered

in determining the fair market value of our common stock, include the recommendation of our finance and planning

committee and of management based on certain data, including discounted cash flow analysis, comparable company

analysis and comparable transaction analysis, as well as contemporaneous valuation reports. After our initial public

offering, the Board of Directors uses the closing price of our common stock on the date of grant as the fair market

value for our common stock. The volatility assumption is based on a combination of the historical volatility of our

common stock and the volatilities of similar companies over a period of time equal to the expected term of the stock

options. The volatilities of similar companies are used in conjunction with our historical volatility because of the

lack of sufficient relevant history equal to the expected term. The expected term of employee stock options

represents the weighted-average period the stock options are expected to remain outstanding. The expected term

assumption is estimated based primarily on the stock options’ vesting terms and remaining contractual life and

employees’ expected exercise and post-vesting employment termination behavior. The risk-free interest rate

assumption is based upon observed interest rates on the grant date appropriate for the term of the employee stock

options. The dividend yield assumption is based on the expectation of no future dividend payouts by us.

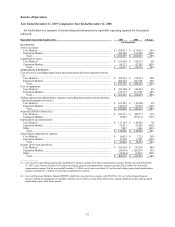

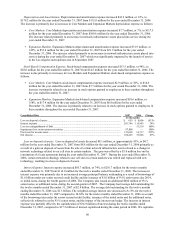

As share-based compensation expense under SFAS No. 123(R) is based on awards ultimately expected to vest, it

is reduced for estimated forfeitures. SFAS No. 123(R) requires forfeitures to be estimated at the time of grant and

revised, if necessary, in subsequent periods if actual forfeitures differ from those estimates. We recorded stock-

based compensation expense of approximately $28.0 million and $14.5 million for the years ended December 31,

2007 and 2006, respectively.

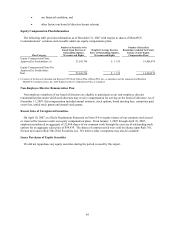

The value of the options is determined by using a Black-Scholes pricing model that includes the following

variables: 1) exercise price of the instrument, 2) fair market value of the underlying stock on date of grant,

3) expected life, 4) estimated volatility and 5) the risk-free interest rate. We utilized the following weighted-average

assumptions in estimating the fair value of the options grants for the years ended December 31, 2007 and 2006: