Metro PCS 2007 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2007 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.63

The increase in customers migrating to higher priced rate plans is primarily the result of our emphasis on

offering additional services under our $45 rate plan which includes unlimited nationwide long distance and

various unlimited data features. In addition, this migration is expected to continue as our higher priced rate

plans become more attractive to our existing customer base.

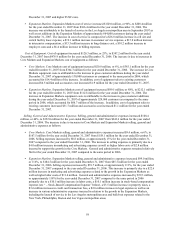

• Expansion Markets. Expansion Markets service revenues increased $149.5 million to $152.9 million for the

year ended December 31, 2006 from $3.4 million for the year ended December 31, 2005. These revenues

were attributable to the launch of the Tampa/Sarasota metropolitan area in October 2005, the

Dallas/Ft. Worth metropolitan area in March 2006, the Detroit metropolitan area in April 2006 and the

expansion of the Tampa/Sarasota area to include the Orlando metropolitan area in November 2006. Net

additions in the Expansion Markets totaled approximately 640,000 customers for the year ended

December 31, 2006.

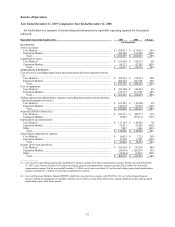

Equipment Revenues: Equipment revenues increased $89.6 million, or 54%, to $255.9 million for the year ended

December 31, 2006 from $166.3 million for the year ended December 31, 2005. The increase is due to increases in

Core Markets and Expansion Markets equipment revenues as follows:

• Core Markets. Core Markets equipment revenues increased $44.6 million, or 27%, to $208.3 million for the

year ended December 31, 2006 from $163.7 million for the year ended December 31, 2005. The increase in

equipment revenues is primarily attributable to the sale of higher priced handset models accounting for

$30.2 million of the increase, coupled with the increase in gross customer additions during the year of

approximately 130,000 customers, which accounted for $14.4 million of the increase.

• Expansion Markets. Expansion Markets equipment revenues increased $45.0 million to $47.6 million for the

year ended December 31, 2006 from $2.6 million for the year ended December 31, 2005. These revenues

were attributable to the launch of the Tampa/Sarasota metropolitan area in October 2005, the

Dallas/Ft. Worth metropolitan area in March 2006, the Detroit metropolitan area in April 2006 and the

expansion of the Tampa/Sarasota area to include the Orlando metropolitan area in November 2006. Gross

additions in the Expansion Markets totaled approximately 730,000 customers for the year ended

December 31, 2006.

The increase in handset model availability is primarily the result of our emphasis on enhancing our product

offerings and appealing to our customer base in connection with our wireless services.

Cost of Services: Cost of Service increased $162.1 million, or 57%, to $445.3 million for the year ended

December 31, 2006 from $283.2 million for the year ended December 31, 2005. The increase is due to increases in

Core Markets and Expansion Markets cost of service as follows:

• Core Markets. Core Markets cost of service increased $67.5 million, or 25%, to $338.9 million for the year

ended December 31, 2006 from $271.4 million for the year ended December 31, 2005. The increase in cost of

service was primarily attributable to a $14.8 million increase in federal universal service fund, or FUSF, fees,

a $13.2 million increase in long distance costs, a $7.7 million increase in cell site and switch facility lease

expense, a $6.4 million increase in customer service expense, a $5.9 million increase in intercarrier

compensation, and a $4.3 million increase in employee costs, all of which are a result of the 23% growth in

our Core Markets customer base and the addition of approximately 350 cell sites to our existing network

infrastructure.

• Expansion Markets. Expansion Markets cost of service increased $94.6 million to $106.4 million for the year

ended December 31, 2006 from $11.8 million for the year ended December 31, 2005. These increases were

attributable to the launch of the Tampa/Sarasota metropolitan area in October 2005, the Dallas/Ft. Worth

metropolitan area in March 2006, the Detroit metropolitan area in April 2006 and the expansion of the

Tampa/Sarasota area to include the Orlando metropolitan area in November 2006. The increase in cost of

service was primarily attributable to a $22.3 million increase in cell site and switch facility lease expense, a

$13.8 million increase in employee costs, a $9.3 million increase in intercarrier compensation, $8.2 million in

long distance costs, $8.2 million in customer service expense and $3.5 million in billing expenses.