Metro PCS 2007 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2007 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44

If Freedom Wireless is successful in its claim for injunctive relief, we could be enjoined from operating our

business in the manner we operate currently, which could require us to redesign our current billing or other systems,

to expend additional capital to change certain of our technologies and operating practices, or could prevent us from

offering certain of our services. In addition, if Freedom Wireless is successful in its claim for monetary damage, we

could be forced to pay substantial damages, including treble damages, for past infringement and/or ongoing royalties

on a portion of our revenues, which could materially adversely impact our financial performance. If Freedom

Wireless prevails in its action, it could have a material adverse effect on our business, financial condition and results

of operations. Moreover, the actions may consume valuable management time, may be very costly to defend and

may distract management attention away from our business.

In addition, we are involved in other litigation from time to time, including litigation regarding intellectual

property claims that we consider to be in the normal course of business. We are not currently party to any other

pending legal proceedings that we believe would, individually or in the aggregate, have a material adverse effect on

our financial condition or results of operations.

Item 4. Submission of Matters to a Vote of Security Holders

None.

PART II

Item 5. Market Price for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of

Equity Securities

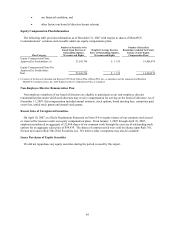

Market Information

Our common stock began trading on April 19, 2007 on the New York Stock Exchange under the symbol “PCS.”

Prior to April 19, 2007, there was no established public trading market for our common stock. The following table

sets forth for the periods indicated the high and low composite per share prices as reported by the New York Stock

Exchange.

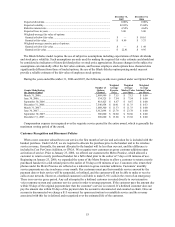

High Low

Fiscal year ended December 31, 2007

Second quarter $ 36.68 $ 27.40

Third quarter 40.33 24.15

Fourth quarter 27.85 15.10

Holders

As of January 31, 2008, the closing price of our common stock was $18.18 per share, there were

348,142,926 shares of our common stock outstanding, and there were approximately 6,800 holders of record of our

common stock.

Dividends

We have never paid or declared any regular dividends on our common stock and do not intend to declare or pay

regular dividends on our common stock in the foreseeable future. The terms of our senior secured credit facility and

the indenture related to the 9¼% senior notes restrict our ability to declare or pay dividends. We currently intend to

retain the future earnings, if any, to invest in our business. Subject to Delaware law, our board of directors will

determine the payment of future dividends on our common stock, if any, and the amount of any dividends in light

of:

• any applicable contractual restrictions limiting our ability to pay dividends;

• our earnings and cash flows;

• our capital requirements;

• our future needs for cash;