Metro PCS 2007 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2007 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetroPCS Communications, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

December 31, 2007, 2006 and 2005

F-31

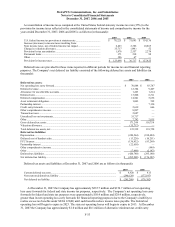

The Company has recorded $28.0 million, $14.5 million and $2.6 million of non-cash stock-based compensation

expense in the years ended December 31, 2007, 2006 and 2005, respectively, and an income tax benefit of

$11.0 million, $5.8 million and $1.0 million, respectively.

As of December 31, 2007, there was approximately $99.2 million of unrecognized stock-based compensation cost

related to unvested share-based compensation arrangements, which is expected to be recognized over a weighted

average period of approximately 2.60 years. Such costs are scheduled to be recognized as follows: $34.9 million in

2008, $31.6 million in 2009, $24.8 million in 2010 and $7.9 million in 2011.

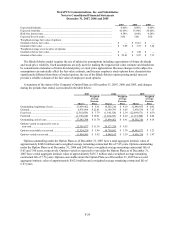

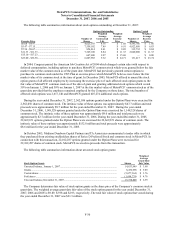

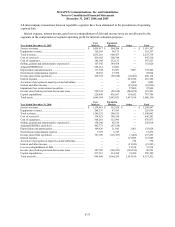

During the year ended December 31, 2007, the following awards were granted under the Company’ s Option

Plans:

Grants Made During the Quarter Ended

Number of

Options

Granted

Weighted

Average

Exercise

Price

Weighted

Average

Market Value

per Share

Weighted

Average

Intrinsic Value

per Share

March 31, 2007................................................................... 1,008,300 $ 11.33 $ 11.33 $ 0.00

June 30, 2007...................................................................... 5,912,098 $ 23.78 $ 23.78 $ 0.00

September 30, 2007............................................................ 906,000 $ 30.60 $ 30.60 $ 0.00

December 31, 2007............................................................. 650,600 $ 15.68 $ 15.68 $ 0.00

Compensation expense is recognized over the requisite service period for the entire award, which is generally the

maximum vesting period of the award.

The fair value of the common stock was determined contemporaneously with the option grants.

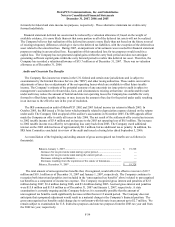

In December 2006, the Company amended stock option agreements of a former member of MetroPCS’ Board of

Directors to extend the contractual life of 405,054 vested options to purchase common stock until December 31,

2006. This amendment resulted in the recognition of additional non-cash stock-based compensation expense of

approximately $4.1 million in the fourth quarter of 2006.

In December 2006, in recognition of efforts related to the Offering and to align executive ownership with the

Company, the Company made a special stock option grant to its named executive officers and certain other eligible

employees. The Company granted stock options to purchase an aggregate of 6,885,000 shares of the Company’ s

common stock to its named executive officers and certain other officers and employees. The purpose of the grant

was also to provide retention of employees following the Company’ s initial public offering as well as to motivate

employees to return value to the Company’ s shareholders through future appreciation of the Company’ s common

stock price. The exercise price for the option grants was $11.33, which was the fair market value of the Company’ s

common stock on the date of the grant as determined by the Company’ s board of directors. In determining the fair

market value of the common stock, consideration was given to the recommendations of the Company’ s finance and

planning committee and of management based on certain data, including discounted cash flow analysis, comparable

company analysis, and comparable transaction analysis, as well as contemporaneous valuation. The stock options

granted to the named executive officers other than the Company’ s CEO and senior vice president and chief

technology officer generally vest on a four-year vesting schedule with 25% vesting on the first anniversary date of

the award and the remainder pro-rata on a monthly basis thereafter. The stock options granted to the Company’ s

CEO vest on a three-year vesting schedule with one-third vesting on the first anniversary date of the award and the

remainder pro-rata on a monthly basis thereafter. The stock options granted to the Company’ s senior vice president

and chief technology officer vest over a two-year vesting schedule with one-half vesting on the first anniversary of

the award and the remainder pro-rata on a monthly basis thereafter.

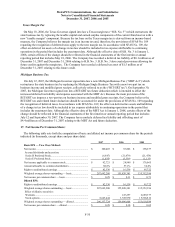

In November 2006, the Company made an election to account for its APIC pool utilizing the short cut method

provided under FSP FAS No. 123(R)-3, “Transition Election Related to Accounting for the Tax Effects of Share-

Based Payments.”

Upon adoption of SFAS No. 123(R), the Company had 946,908 options that were subject to variable accounting

under APB No. 25, and related interpretations. As the options were fully vested upon adoption of SFAS No. 123(R)

and there have been no subsequent modifications, no incremental stock-based compensation expense has been

recognized in 2006 and 2007. During the year ended December 31, 2005, $2.3 million of stock-based compensation