Metro PCS 2007 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2007 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MetroPCS Communications, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

December 31, 2007, 2006 and 2005

F-21

licenses in the FCC auction in May 1996. The repayment resulted in a loss on extinguishment of debt of

$1.0 million.

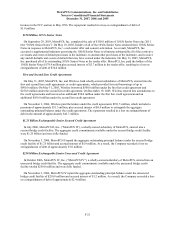

$150 Million 10¾% Senior Notes

On September 29, 2003, MetroPCS, Inc. completed the sale of $150.0 million of 10¾% Senior Notes due 2011

(the “10¾% Senior Notes”). On May 10, 2005, holders of all of the 10¾% Senior Notes tendered their 10¾% Senior

Notes in response to MetroPCS, Inc.’ s cash tender offer and consent solicitation. As a result, MetroPCS, Inc.

executed a supplemental indenture governing the 10¾% Senior Notes to eliminate substantially all of the restrictive

covenants and event of default provisions in the indenture, to amend other provisions of the indenture, and to waive

any and all defaults and events of default that may have existed under the indenture. On May 31, 2005, MetroPCS,

Inc. purchased all of its outstanding 10¾% Senior Notes in the tender offer. MetroPCS, Inc. paid the holders of the

10¾% Senior Notes $178.9 million plus accrued interest of $2.7 million in the tender offer, resulting in a loss on

extinguishment of debt of $34.0 million.

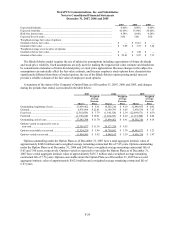

First and Second Lien Credit Agreements

On May 31, 2005, MetroPCS, Inc. and Wireless, both wholly-owned subsidiaries of MetroPCS, entered into the

first and second lien credit agreements, or credit agreements, which provided for total borrowings of up to

$900.0 million. On May 31, 2005, Wireless borrowed $500.0 million under the first lien credit agreement and

$250.0 million under the second lien credit agreement. On December 19, 2005, Wireless entered into amendments to

the credit agreements and borrowed an additional $50.0 million under the first lien credit agreement and an

additional $100.0 million under the second lien credit agreement.

On November 3, 2006, Wireless paid the lenders under the credit agreements $931.5 million, which included a

premium of approximately $31.5 million, plus accrued interest of $8.6 million to extinguish the aggregate

outstanding principal balance under the credit agreements. The repayment resulted in a loss on extinguishment of

debt in the amount of approximately $42.7 million.

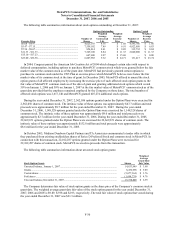

$1.25 Billion Exchangeable Senior Secured Credit Agreement

In July 2006, MetroPCS II, Inc. (“MetroPCS II”), a wholly-owned subsidiary of MetroPCS, entered into a

secured bridge credit facility. The aggregate credit commitments available under the secured bridge credit facility

were $1.25 billion and were fully funded.

On November 3, 2006, MetroPCS II repaid the aggregate outstanding principal balance under the secured bridge

credit facility of $1.25 billion and accrued interest of $5.9 million. As a result, the Company recorded a loss on

extinguishment of debt of approximately $7.0 million.

$250 Million Exchangeable Senior Unsecured Credit Agreement

In October 2006, MetroPCS IV, Inc. (“MetroPCS IV”), a wholly-owned subsidiary of MetroPCS, entered into an

unsecured bridge credit facility. The aggregate credit commitments available under the unsecured bridge credit

facility totaled $250.0 million and were fully funded.

On November 3, 2006, MetroPCS IV repaid the aggregate outstanding principal balance under the unsecured

bridge credit facility of $250.0 million and accrued interest of $1.2 million. As a result, the Company recorded a loss

on extinguishment of debt of approximately $2.4 million.