Metro PCS 2007 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2007 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.50

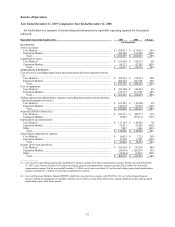

reduction to the effective rate in the year of resolution. Tax reserves as of December 31, 2007 were $26.0 million of

which $4.8 million and $21.2 million are presented on the consolidated balance sheet in accounts payable and

accrued expenses and other long-term liabilities, respectively.

On January 1, 2007, the Company adopted FASB Interpretation No. 48 “Accounting for Uncertainty in Income

Taxes,” (“FIN 48”). FIN 48, which clarifies the accounting for uncertainty in income taxes recognized in the

financial statements in accordance with SFAS No. 109. FIN 48 provides guidance on the financial statement

recognition and measurement of a tax position taken or expected to be taken in a tax return. FIN 48 also provides

guidance on derecognition, classification, interest and penalties, accounting in interim periods, disclosures, and

transition. FIN 48 requires significant judgment in determining what constitutes an individual tax position as well as

assessing the outcome of each tax position. Changes in judgment as to recognition or measurement of tax positions

can materially affect the estimate of the effective tax rate and consequently, affect our operating results.

Property and Equipment

Depreciation on property and equipment is applied using the straight-line method over the estimated useful lives

of the assets once the assets are placed in service, which are seven to ten years for network infrastructure assets

including capitalized interest, three to seven years for office equipment, which includes computer equipment, three

to seven years for furniture and fixtures and five years for vehicles. Leasehold improvements are amortized over the

shorter of the remaining term of the lease and any renewal periods reasonably assured or the estimated useful life of

the improvement. The estimated life of property and equipment is based on historical experience with similar assets,

as well as taking into account anticipated technological or other changes. If technological changes were to occur

more rapidly than anticipated or in a different form than anticipated, the useful lives assigned to these assets may

need to be shortened, resulting in the recognition of increased depreciation expense in future periods. Likewise, if

the anticipated technological or other changes occur more slowly than anticipated, the life of the assets could be

extended based on the life assigned to new assets added to property and equipment. This could result in a reduction

of depreciation expense in future periods.

We assess the impairment of long-lived assets whenever events or changes in circumstances indicate the carrying

value may not be recoverable. Factors we consider important that could trigger an impairment review include

significant underperformance relative to historical or projected future operating results or significant changes in the

manner of use of the assets or in the strategy for our overall business. The carrying amount of a long-lived asset is

not recoverable if it exceeds the sum of the undiscounted cash flows expected to result from the use and eventual

disposition of the asset. When we determine that the carrying value of a long-lived asset is not recoverable, we

measure any impairment based upon a projected discounted cash flow method using a discount rate we determine to

be commensurate with the risk involved and would be recorded as a reduction in the carrying value of the related

asset and charged to results of operations. If actual results are not consistent with our assumptions and estimates, we

may be exposed to an additional impairment charge associated with long-lived assets. The carrying value of property

and equipment was approximately $1.9 billion as of December 31, 2007.

Long-Term Investments

The Company accounts for its investment securities in accordance with SFAS No. 115, “Accounting for Certain

Investments in Debt and Equity Securities.” At December 31, 2007, all of the Company’ s long-term investment

securities were reported at fair value. Due to the lack of availability of observable market quotes on the Company’ s

investment portfolio of auction rate securities, the fair value was estimated based on our broker-dealer valuation

models and an internal analysis by management of other-than-temporary impairment factors. The broker-dealer

models considered credit default risks, the liquidity of the underlying security and overall capital market liquidity.

Management also looked to other marketplace transactions, and information received from other third party brokers

in order to assess whether the fair value based on the broker-dealer valuation models was reasonable.

Declines in fair value that are considered other-than-temporary are charged to earnings and those that are

considered temporary are reported as a component of other comprehensive income in stockholders’ equity. The

Company has recorded an impairment charge of $97.8 million during the year ended December 31, 2007, reflecting

the portion of the auction rate security holdings that the Company has concluded have an other-than-temporary

decline in value.

The valuation of the Company’ s investment portfolio is subject to uncertainties that are difficult to predict.

Factors that may impact the Company’ s valuation include changes to credit ratings of the securities as well as the