Metro PCS 2007 Annual Report Download - page 148

Download and view the complete annual report

Please find page 148 of the 2007 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetroPCS Communications, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

December 31, 2007, 2006 and 2005

F-49

See Note 2 for the non-cash increase in the Company’ s asset retirement obligations.

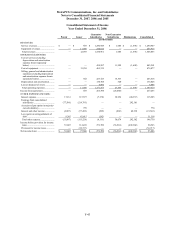

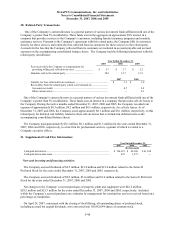

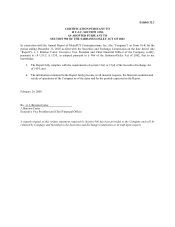

22. Fair Value of Financial Instruments:

The following methods and assumptions were used to estimate the fair value of each class of financial

instruments for which it is practicable to estimate that value:

Long-Term Debt

The fair value of the Company’ s long-term debt is estimated based on the quoted market prices for the same or

similar issues or on the current rates offered to the Company for debt of the same remaining maturities.

The estimated fair values of the Company’ s financial instruments are as follows (in thousands):

2007 2006

Carrying

Amount

Fair Value

Carrying

Amount

Fair Value

Senior Secured Credit Facility........................................................ $ 1,580,000 $ 1,607,734 $ 1,596,000 $ 1,597,219

9¼% Senior Notes.......................................................................... 1,400,000 1,314,250 1,000,000 1,032,500

Cash flow hedging derivatives........................................................ (23,502) (23,502) 1,865 1,865

Short-term investments................................................................... — — 390,651 390,651

Long-term investments................................................................... 36,050 36,050 390,651 390,651

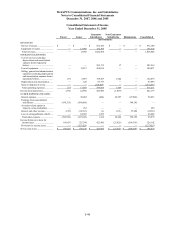

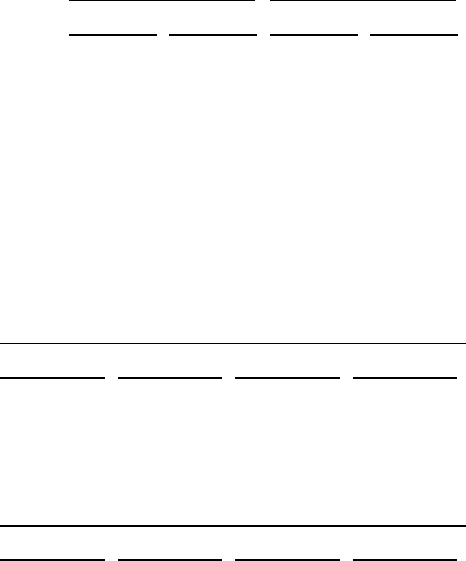

23. Quarterly Financial Data (Unaudited):

The following financial information reflects all normal recurring adjustments that are, in the opinion of

management, necessary for a fair statement of the Company’ s results of operations for the interim periods.

Summarized data for each interim period for the years ended December 31, 2007 and 2006 is as follows (in

thousands, except per share data):

Three Months Ended

March 31,

2007

June 30,

2007

September 30,

2007

December 31,

2007

Total revenues .................................................................. $ 536,686 $ 551,176 $ 556,738 $ 591,134

Income from operations.................................................... 102,676 132,062 133,138 92,238

Net income (loss)(1)......................................................... 36,352 58,094 53,108 (47,150)

Net income (loss) per common share — basic ................. $ 0.11 $ 0.17 $ 0.15 $ (0.14)

Net income (loss) per common share — diluted............... $ 0.11 $ 0.17 $ 0.15 $ (0.14)

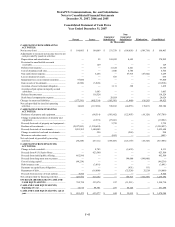

Three Months Ended

March 31,

2006

June 30,

2006

September 30,

2006

December 31,

2006

Total revenues .................................................................. $ 329,461 $ 368,194 $ 396,116 $ 453,092

Income from operations.................................................... 46,999 54,099 69,394 66,761

Net income (loss)(2)......................................................... 18,369 22,989 29,266 (16,818)

Net income (loss) per common share — basic ................. $ 0.04 $ 0.06 $ 0.08 $ (0.15)

Net income (loss) per common share — diluted............... $ 0.04 $ 0.06 $ 0.08 $ (0.15)

__________

(1) During the three months ended September 30, 2007 and December 31, 2007, the Company recognized an impairment loss on investment

securities in the amount of approximately $ 15.0 million and $82.8 million, respectively.

(2) During the three months ended December 31, 2006, the Company repaid all of its outstanding obligations under the credit agreements,

the secured bridge credit facility and the unsecured bridge credit facility resulting in a loss on extinguishment of debt in the amount of

approximately $51.8 million.