Metro PCS 2007 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2007 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MetroPCS Communications, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

December 31, 2007, 2006 and 2005

F-26

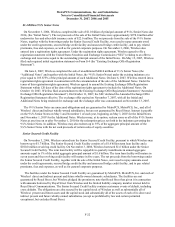

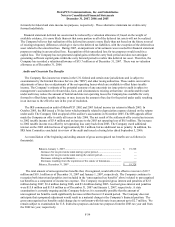

On January 7, 2008, Freedom Wireless, Inc., or Freedom Wireless, filed suit against Verisign, Inc., the

Company’ s billing vendor, and the Company in the United States District Court for the Northern District of

California, San Francisco Division, for infringement of U.S. Patent No. 5,722,067 entitled “Security Cellular

Telecommunications System,” U.S. Patent No. 6,157,823 entitled “Security Cellular Telecommunications System,”

and U.S. Patent No. 6,236,851 entitled “Prepaid Security Cellular Telecommunications System,” or collectively the

Freedom Wireless Patents, held by Freedom Wireless. The complaint seeks both injunctive relief and monetary

damages, including treble damages, for the Company’ s alleged infringement of the Freedom Wireless Patents. The

Company plans to vigorously defend against Freedom Wireless’ claims relating to the Freedom Wireless Patents.

The Company has tendered this action to Verisign and Verisign has indicated that it is reviewing the Company’ s

indemnification request. Verisign also has indicated that it plans to leave the telecommunications service business

and cease providing the Company with billing services at the end of the Company’ s current contract. The Company

can give no assurance that Verisign will defend the Company against this action or that Verisign may not cease

providing the Company with billing services altogether.

If Freedom Wireless is successful in its claim for injunctive relief, the Company could be enjoined from

operating its business in the manner it operates currently, which could require the Company to redesign its current

billing or other systems, to expend additional capital to change certain of its technologies and operating practices, or

could prevent the Company from offering certain of its services. In addition, if Freedom Wireless is successful in its

claim for monetary damage, the Company could be forced to pay substantial damages, including treble damages, for

past infringement and/or ongoing royalties on a portion of its revenues, which could materially adversely impact the

Company’ s financial performance. If Freedom Wireless prevails in its action, it could have a material adverse effect

on the Company’ s business, financial condition and results of operations. The Company plans to vigorously defend

against Freedom Wireless’ claims related to the Freedom Wireless Patents.

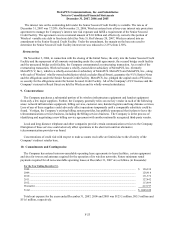

Litigation

The Company is involved in various claims and other legal actions, including litigation regarding intellectual

property claims, arising in the ordinary course of business. The ultimate disposition of these matters is not expected

to have a material adverse impact on the Company’ s financial position, results of operations or liquidity.

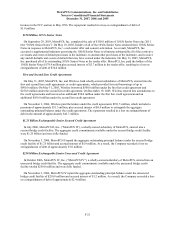

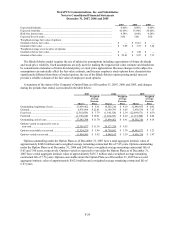

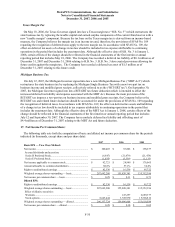

11. Series D Cumulative Convertible Redeemable Participating Preferred Stock:

In July 2000, MetroPCS, Inc. executed a Securities Purchase Agreement, which was subsequently amended (as

amended, the “SPA”). Under the SPA, MetroPCS, Inc. issued shares of Series D Preferred Stock. In July 2004, each

share of MetroPCS, Inc. Series D Preferred Stock was converted into a share of Series D Preferred Stock of

MetroPCS. Dividends accrued at an annual rate of 6% of the liquidation value of $100 per share on the Series D

Preferred Stock. Dividends of $6.5 million, $21.0 million and $21.0 million were accrued for the years ended

December 31, 2007, 2006 and 2005, respectively, and were included in the Series D Preferred Stock balance.

Each share of Series D Preferred Stock was to automatically convert into common stock upon (i) completion of a

Qualified Public Offering (as defined in the SPA), (ii) MetroPCS’ common stock trading (or in the case of a merger

or consolidation of MetroPCS with another company, other than a sale or change of control of MetroPCS, the shares

received in such merger or consolidation having traded immediately prior to such merger and consolidation) on a

national securities exchange for a period of 30 consecutive trading days above a price that implies a market

valuation of the Series D Preferred Stock in excess of twice the initial purchase price of the Series D Preferred

Stock, or (iii) the date specified by the holders of two-thirds of the outstanding Series D Preferred Stock. The

Series D Preferred Stock and the accrued but unpaid dividends thereon were convertible into common stock at

$3.13 per share of common stock, which per share amount is subject to adjustment in accordance with the terms of

MetroPCS’ Second Amended and Restated Articles of Incorporation. On April 24, 2007, MetroPCS consummated

the Offering and all outstanding shares of Series D Preferred Stock, including accrued but unpaid dividends, were

converted into 144,857,320 shares of common stock.

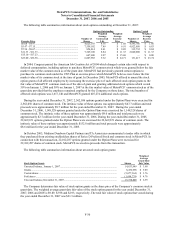

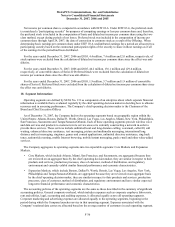

12. Series E Cumulative Convertible Redeemable Participating Preferred Stock:

MetroPCS entered into a stock purchase agreement, dated as of August 30, 2005, under which MetroPCS issued

500,000 shares of Series E Preferred Stock for $50.0 million in cash. Total proceeds to MetroPCS were