Metro PCS 2007 Annual Report Download - page 147

Download and view the complete annual report

Please find page 147 of the 2007 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetroPCS Communications, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

December 31, 2007, 2006 and 2005

F-48

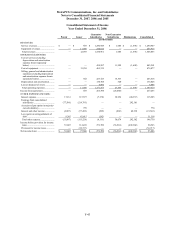

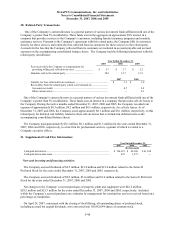

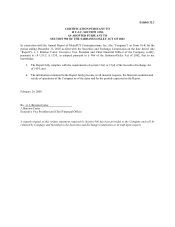

20. Related-Party Transactions:

One of the Company’ s current directors is a general partner of various investment funds affiliated with one of the

Company’ s greater than 5% stockholders. These funds own in the aggregate an approximate 20% interest in a

company that provides services to the Company’ s customers, including handset insurance programs and roadside

assistance services. Pursuant to the Company’ s agreement with this related party, the Company bills its customers

directly for these services and remits the fees collected from its customers for these services to the related party.

Accruals for the fees that the Company collected from its customers are included in accounts payable and accrued

expenses on the accompanying consolidated balance sheets. The Company had the following transactions with this

related party (in millions):

Year Ended December 31,

2007 2006 2005

Fees received by the Company as compensation for

providing billing and collection services. ........................... $ 5.7 $ 2.7 $ 2.2

Handsets sold to the related party ......................................... 10.8 12.7 13.2

2007 2006

Liability for fees collected from customers ................................................. $ 3.3 $ 3.0

Receivables from the related party which were included in:........................

Accounts receivable .................................................................................. 0.7 0.8

Other current assets.................................................................................... — 0.1

One of the Company’ s current directors is a general partner of various investment funds affiliated with one of the

Company’ s greater than 5% stockholders. These funds own an interest in a company that provides cell site leases to

the Company. During the twelve months ended December 31, 2007, 2006 and 2005, the Company recorded rent

expense of approximately $0.3 million, $0.2 million and $0.1 million, respectively, for cell site leases. As of

December 31, 2007 and 2006, the Company owed approximately $0.1 million and $0.1 million, respectively, to this

related party for deferred rent liability related to these cell site leases that is included in deferred rents on the

accompanying consolidated balance sheets.

The Company paid approximately $0.1 million, $0.1 million and $1.3 million for the years ended December 31,

2007, 2006 and 2005, respectively, to a law firm for professional services, a partner of which is related to a

Company executive officer.

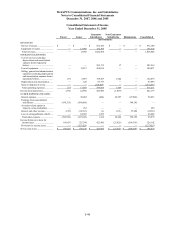

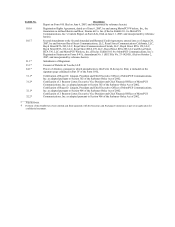

21. Supplemental Cash Flow Information:

Year Ended December 31,

2007 2006 2005

(In thousands)

Cash paid for interest................................................................................................. $ 194,921 $ 86,380 $ 41,360

Cash paid for income taxes........................................................................................ 423 3,375 —

Non-cash investing and financing activities:

The Company accrued dividends of $6.5 million, $21.0 million and $21.0 million related to the Series D

Preferred Stock for the years ended December 31, 2007, 2006 and 2005, respectively.

The Company accrued dividends of $0.9 million, $3.0 million and $1.0 million related to the Series E Preferred

Stock for the years ended December 31, 2007, 2006 and 2005.

Net changes in the Company’ s accrued purchases of property, plant and equipment were $42.5 million,

$28.5 million and $25.3 million for the years ended December 31, 2007, 2006 and 2005, respectively. Included

within the Company’ s accrued purchases are estimates by management for construction services received based on a

percentage of completion.

On April 24, 2007, concurrent with the closing of the Offering, all outstanding shares of preferred stock,

including accrued but unpaid dividends, were converted into 150,962,644 shares of common stock.