Metro PCS 2007 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2007 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetroPCS Communications, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

December 31, 2007, 2006 and 2005

F-35

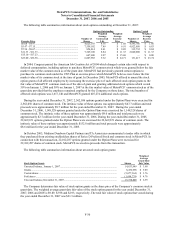

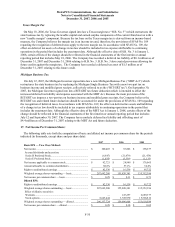

Texas Margin Tax

On May 18, 2006, the Texas Governor signed into law a Texas margin tax (“H.B. No. 3”) which restructures the

state business tax by replacing the taxable capital and earned surplus components of the current franchise tax with a

new “taxable margin” component. Because the tax base on the Texas margin tax is derived from an income-based

measure, the Company believes the margin tax is an income tax and, therefore, the provisions of SFAS No. 109

regarding the recognition of deferred taxes apply to the new margin tax. In accordance with SFAS No. 109, the

effect on deferred tax assets of a change in tax law should be included in tax expense attributable to continuing

operations in the period that includes the enactment date. Although the effective date of H.B. No. 3 is January 1,

2008, certain effects of the change should be reflected in the financial statements of the first interim or annual

reporting period that includes May 18, 2006. The Company has recorded a deferred tax liability of $0.1 million as of

December 31, 2007 and December 31, 2006 relating to H.B. No. 3. H.B. No. 3 also created provisions allowing for

future credits against the margin tax. The Company has recorded a deferred tax asset of $1.5 million as of

December 31, 2007 relating to this future credit.

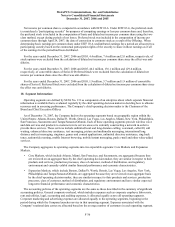

Michigan Business Tax

On July 12, 2007, the Michigan Governor signed into law a new Michigan Business Tax (“MBT Act”) which

restructures the state business tax by replacing the Michigan Single Business Tax with a new two-part tax on

business income and modified gross receipts, collectively referred to as the (“BIT/GRT tax”). On September 30,

2007, the Michigan Governor signed into law a BIT/GRT tax future deduction which is intended to offset the

increased deferred tax liability and expense associated with the MBT Act. Because the main provision of the

BIT/GRT tax imposes a two-part tax on business income and modified gross receipts, the Company believes the

BIT/GRT tax and related future deduction should be accounted for under the provisions of SFAS No. 109 regarding

the recognition of deferred taxes. In accordance with SFAS No. 109, the effect on deferred tax assets and liabilities

of a change in tax law should be included in tax expense attributable to continuing operations in the period that

includes the enactment date. Although the effective date of the MBT Act is January 1, 2008, certain effects of the

change should be reflected in the financial statements of the first interim or annual reporting period that includes

July 12 and September 30, 2007. The Company has recorded a deferred tax liability and offsetting asset of

$4.4 million as of December 31, 2007 relating to the MBT Act and future deduction.

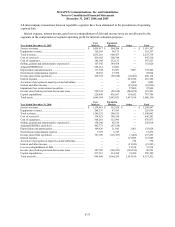

17. Net Income Per Common Share:

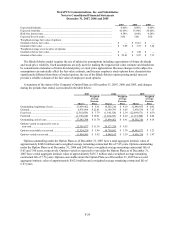

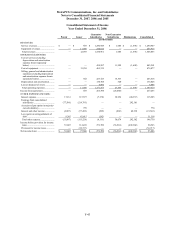

The following table sets forth the computation of basic and diluted net income per common share for the periods

indicated (in thousands, except share and per share data):

2007 2006 2005

Basic EPS — Two Class Method:

Net income ............................................................................... $ 100,403 $ 53,806 $ 198,677

Accrued dividends and accretion:

Series D Preferred Stock......................................................... (6,647) (21,479) (21,479)

Series E Preferred Stock......................................................... (1,035) (3,339) (1,133)

Net income applicable to common stock.................................. $ 92,721 $ 28,988 $ 176,065

Amount allocable to common shareholders.............................. 88.8% 57.1% 54.4%

Rights to undistributed earnings ............................................... $ 82,330 $ 16,539 $ 95,722

Weighted average shares outstanding — basic......................... 287,692,280 155,820,381 135,352,396

Net income per common share — basic ................................... $ 0.29 $ 0.11 $ 0.71

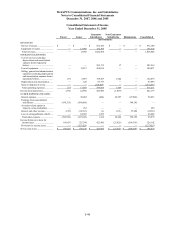

Diluted EPS:

Rights to undistributed earnings ............................................... $ 82,330 $ 16,539 $ 95,722

Weighted average shares outstanding — basic......................... 287,692,280 155,820,381 135,352,396

Effect of dilutive securities:

Warrants ................................................................................. — 147,257 2,689,377

Stock options .......................................................................... 8,645,444 3,728,970 15,568,816

Weighted average shares outstanding — diluted...................... 296,337,724 159,696,608 153,610,589

Net income per common share — diluted ................................ $ 0.28 $ 0.10 $ 0.62