Metro PCS 2007 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2007 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MetroPCS Communications, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

December 31, 2007, 2006 and 2005

F-27

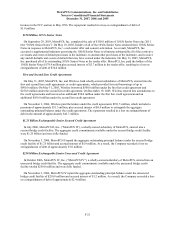

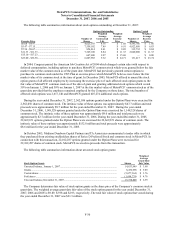

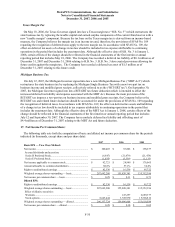

$46.7 million, net of transaction costs of approximately $3.3 million. The Series E Preferred Stock and the Series D

Preferred Stock ranked equally with respect to dividends, conversion rights and liquidation preferences. Dividends

on the Series E Preferred Stock accrued at an annual rate of 6% of the liquidation value of $100 per share. Dividends

of $0.9 million, $3.0 million and $1.0 million were accrued for the years ended December 31, 2007, 2006 and 2005,

respectively, and were included in the Series E Preferred Stock balance.

Each share of Series E Preferred Stock was to be converted into common stock of MetroPCS upon (i) the

completion of a Qualifying Public Offering, (as defined in the Second Amended and Restated Stockholders

Agreement), (ii) the common stock trading (or, in the case of a merger or consolidation of MetroPCS with another

company, other than as a sale or change of control of MetroPCS, the shares received in such merger or consolidation

having traded immediately prior to such merger or consolidation) on a national securities exchange for a period of

30 consecutive trading days above a price implying a market valuation of the Series D Preferred Stock over twice

the Series D Preferred Stock initial purchase price, or (iii) the date specified by the holders of two-thirds of the

Series E Preferred Stock. The Series E Preferred Stock was convertible into common stock at $9.00 per share, which

per share amount was subject to adjustment in accordance with the terms of the Second Amended and Restated

Articles of Incorporation of MetroPCS. On April 24, 2007, MetroPCS consummated the Offering and all

outstanding shares of Series E Preferred Stock, including accrued but unpaid dividends, were converted into

6,105,324 shares of common stock.

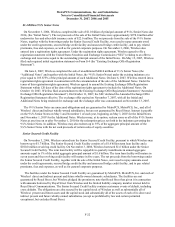

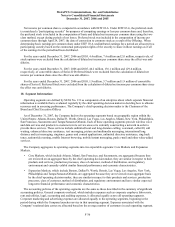

13. Capitalization:

Warrants

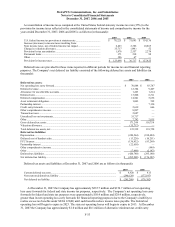

From inception through February 1998, MetroPCS, Inc. issued various warrants to purchase common stock in

conjunction with sales of stock and in exchange for consulting services, which were converted into warrants in

MetroPCS in July 2004. As of December 31, 2006, there were no remaining warrants outstanding.

During the year ended December 31, 2006, 526,950 warrants, with an exercise price of $0.0009 per warrant, were

exercised for 526,950 shares of common stock.

Common Stock Issued to Directors

Non-employee members of MetroPCS’ Board of Directors receive compensation for serving on the Board of

Directors, pursuant to MetroPCS’ Non-Employee Director Remuneration Plan. As of December 31, 2007, the

annual retainer provided under the Non-Employee Director Remuneration Plan may be paid in cash, common stock,

or a combination of cash and common stock at the election of each director. During the years ended December 31,

2007 and 2006, non-employee members of the Board of Directors were issued 31,230 and 49,725 shares of common

stock, respectively, as payment of their annual retainer.

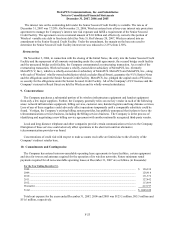

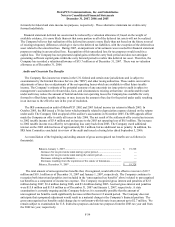

Stockholder Rights Plan

On March 27, 2007, in connection with the Offering, the Company adopted a Stockholder Rights Plan. Under the

Stockholder Rights Plan, each share of the Company’ s common stock includes one right to purchase one one-

thousandth of a share of series A junior participating preferred stock. The rights will separate from the common

stock and become exercisable (1) ten calendar days after public announcement that a person or group of affiliated or

associated persons has acquired, or obtained the right to acquire, beneficial ownership of 15% of the Company’ s

outstanding common stock or (2) ten business days following the start of a tender offer or exchange offer that would

result in a person’ s acquiring beneficial ownership of 15% or more of the Company’ s outstanding common stock. A

beneficial owner holding 15% or more of MetroPCS’ common stock is referred to as an “acquiring person” under

the Stockholder Rights Plan.