Metro PCS 2007 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2007 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetroPCS Communications, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

December 31, 2007, 2006 and 2005

F-18

(collectively, the “Credit Agreements”), to mitigate the impact of interest rate changes. An interest rate cap

represents a right to receive cash if interest rates rise above a contractual strike rate. At December 31, 2005, the

interest rate cap agreement had a notional value of $450.0 million and Wireless would receive payments on a

semiannual basis if the six-month LIBOR interest rate exceeds 3.75% through January 1, 2007 and 6.00% through

the agreement maturity date of July 1, 2008. Wireless paid $1.9 million upon execution of the interest rate cap

agreement. On November 21, 2006, Wireless terminated its interest rate cap agreement and received proceeds of

approximately $4.3 million upon termination of the agreement. The proceeds from the termination of the agreement

approximated its carrying value. The remaining unrealized gain associated with the interest rate cap agreement was

reclassified out of accumulated other comprehensive income into earnings as a reduction of interest expense.

On November 21, 2006, Wireless entered into a three-year interest rate protection agreement to manage the

Company’ s interest rate risk exposure and fulfill a requirement of Wireless’ Senior Secured Credit Facility. The

agreement covers a notional amount of $1.0 billion and effectively converts this portion of Wireless’ variable rate

debt to fixed-rate debt. The quarterly interest settlement periods began on February 1, 2007. The interest rate

protection agreement expires on February 1, 2010. This financial instrument is reported in other long-term liabilities

at fair market value of approximately $23.5 million as of December 31, 2007. The net change in fair value of

$13.6 million is reported in accumulated other comprehensive income (loss) in the consolidated balance sheets, net

of income taxes in the amount of approximately $9.9 million. As of December 31, 2006, this financial instrument

was reported in long-term investments at fair market value, which was approximately $1.9 million.

The interest rate protection agreement has been designated as a cash flow hedge. If a derivative is designated as a

cash flow hedge and the hedging relationship qualifies for hedge accounting under the provisions of SFAS No. 133,

the effective portion of the change in fair value of the derivative is recorded in accumulated other comprehensive

income (loss) and reclassified to interest expense in the period in which the hedged transaction affects earnings. The

ineffective portion of the change in fair value of a derivative qualifying for hedge accounting is recognized in

earnings in the period of the change. For the year ended December 31, 2007, the change in fair value did not result

in ineffectiveness.

At the inception of the cash flow hedge and quarterly thereafter, the Company performs an assessment to

determine whether changes in the fair values or cash flows of the derivatives are deemed highly effective in

offsetting changes in the fair values or cash flows of the hedged transaction. If at any time subsequent to the

inception of the cash flow hedge, the assessment indicates that the derivative is no longer highly effective as a

hedge, the Company will discontinue hedge accounting and recognize all subsequent derivative gains and losses in

results of operations.

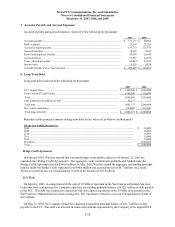

6. Intangible Assets:

The changes in the carrying value of intangible assets during the years ended December 31, 2007 and 2006 are as

follows (in thousands):

FCC Licenses

Microwave

Relocation

Costs

Balance at December 31, 2005 ....................................................................................... $ 681,299 $ 9,187

Additions ........................................................................................................................ 1,391,586 —

Balance at December 31, 2006 ....................................................................................... $ 2,072,885 $ 9,187

Additions ........................................................................................................................ 10 918

Balance at December 31, 2007 ....................................................................................... $ 2,072,895 $ 10,105

FCC licenses represent the 14 C-Block PCS licenses acquired by the Company in the FCC auction in May 1996,

the AWS licenses acquired in FCC Auction 66 and FCC licenses acquired from other carriers. FCC licenses also

represent licenses acquired in 2005 by Royal Street Communications in Auction No. 58.

The grant of the licenses by the FCC subjects the Company to certain FCC ongoing ownership restrictions.

Should the Company cease to continue to qualify under such ownership restrictions, the PCS and AWS licenses may

be subject to revocation or require the payment of fines or forfeitures. All FCC licenses held by the Company will

expire in ten years for PCS licenses and fifteen years for AWS licenses from the initial date of grant of the license