Metro PCS 2007 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2007 Metro PCS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

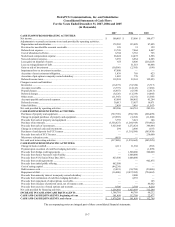

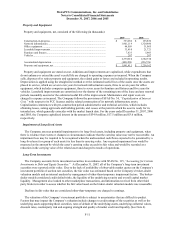

MetroPCS Communications, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

December 31, 2007, 2006 and 2005

F-17

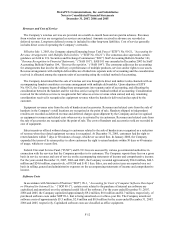

C9 Wireless, LLC has a right to sell, or put, its limited liability company interests in Royal Street

Communications to the Company at specific future dates based on a contractually determined amount (the “Put

Right”). The Put Right represents an unconditional obligation of MetroPCS and its wholly-owned subsidiaries to

purchase from C9 Wireless, LLC its limited liability company interests in Royal Street Communications. In

accordance with SFAS No. 150, “Accounting for Certain Financial Instruments with Characteristics of both

Liabilities and Equity,” this obligation is recorded as a liability and is measured at each reporting date at the amount

of cash that would be required to settle the obligation under the contract terms if settlement occurred at the reporting

date.

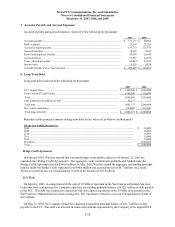

4. Investments:

The Company had no short-term investments at December 31, 2007. Short-term investments at December 31,

2006 consisted of the following (in thousands):

2006

Amortized

Cost

Gross

Unrealized

Gains

Gross

Unrealized

Losses

Aggregate

Fair

Value

United States government and agencies ......................................... $ 2,000 $ — $ (15) $ 1,985

Auction rate securities .................................................................... 290,055 — (30) 290,025

Commercial paper .......................................................................... 98,428 213 — 98,641

Total short-term investments.......................................................... $ 390,483 $ 213 $ (45) $ 390,651

The Company has historically invested its substantial cash balances in, among other things, securities issued and

fully guaranteed by the United States or any state, highly rated commercial paper and auction rate securities, money

market funds meeting certain criteria, and demand deposits. These investments are subject to credit, liquidity,

market and interest rate risk. At December 31, 2007, the Company had invested substantially all of its cash and cash

equivalents in money market funds consisting of treasury securities.

The Company holds investments of $133.9 million in certain auction rate securities some of which are secured

by collateralized debt obligations with a portion of the underlying collateral being mortgage securities or related to

mortgage securities. Consistent with the Company's investment policy guidelines, the auction rate securities

investments held by the Company all had AAA credit ratings at the time of purchase. With the liquidity issues

experienced in global credit and capital markets, the auction rate securities held by the Company at December 31,

2007 have experienced multiple failed auctions as the amount of securities submitted for sale in the auctions has

exceeded the amount of purchase orders. In addition, three auction rate securities held by the Company have been

placed on credit watch. However, as of January 31, 2008, all of the auction rate securities held by the Company still

retain a AAA/Aaa rating as reported by Standard and Poors and Moody’ s Investors Service.

The estimated market value of the Company's auction rate security holdings at December 31, 2007 was

approximately $36.1 million, which reflects a $97.8 million adjustment to the principal value of $133.9 million.

Although the auction rate securities continue to pay interest according to their stated terms, based on statements

received from the Company’ s broker and an analysis of other-than-temporary impairment factors, the Company has

recorded an impairment charge of $97.8 million during the year ended December 31, 2007, reflecting the portion of

auction rate security holdings that the Company has concluded have an other-than-temporary decline in value.

Historically, given the liquidity created by the auctions, the Company’ s auction rate securities were presented as

current assets under short-term investments on the Company's balance sheet. Given the failed auctions, the

Company's auction rate securities are illiquid until there is a successful auction for them. Accordingly, the entire

amount of such remaining auction rate securities has been reclassified from current to non-current assets and is

presented in long-term investments on the accompanying balance sheet as of December 31, 2007. If uncertainties in

the credit and capital markets continue or these markets deteriorate further, the Company may incur additional

impairments to its auction rate securities.

5. Derivative Instruments and Hedging Activities:

On June 27, 2005, Wireless entered into a three-year interest rate cap agreement, as required by its First Lien

Credit Agreement, maturing May 31, 2011, and Second Lien Credit Agreement maturing May 31, 2012,