MasterCard 2012 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2012 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

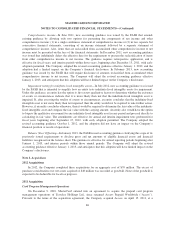

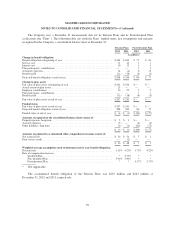

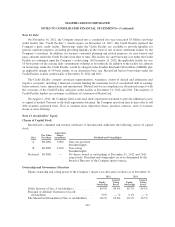

Investment Income:

Components of net investment income for each of the years ended December 31 were as follows:

2012 2011 2010

(in millions)

Interest income .............................................. $ 36 $ 44 $ 48

Investment securities available-for-sale:

Gross realized gains ...................................... 2 10 9

Gross realized losses ...................................... (1) (2) —

Total investment income, net ................................... $ 37 $ 52 $ 57

Interest income primarily consists of interest income generated from cash, cash equivalents, investment

securities available-for-sale and investment securities held-to-maturity.

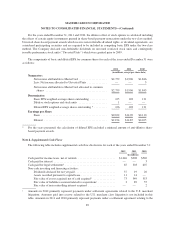

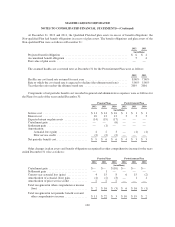

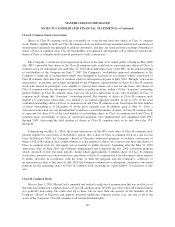

Note 6. Prepaid Expenses and Other Assets

Prepaid expenses and other current assets consisted of the following at December 31:

2012 2011

(in millions)

Customer and merchant incentives ......................................... $222 $190

Investment securities held-to-maturity ...................................... 36 —

Prepaid income taxes .................................................... 77 35

Income taxes receivable ................................................. 163 35

Other ................................................................ 183 144

Total prepaid expenses and other current assets ............................... $681 $404

Other assets consisted of the following at December 31:

2012 2011

(in millions)

Customer and merchant incentives ......................................... $404 $409

Nonmarketable equity investments ......................................... 249 160

Auction rate securities available-for-sale, at fair value .......................... 32 70

Investment securities held-to-maturity ...................................... — 36

Income taxes receivable ................................................. 72 15

Other ................................................................ 52 46

Total other assets ....................................................... $809 $736

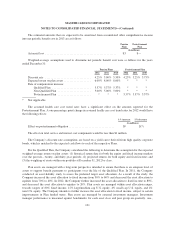

Certain customer and merchant business agreements provide incentives upon entering into the agreement.

Customer and merchant incentives represent payments made or amounts to be paid to customers and merchants

under business agreements. Amounts to be paid for these incentives and the related liability were included in

accrued expenses and other liabilities. Once the payment is made, the liability is relieved. Costs directly related

to entering into such an agreement are deferred and amortized over the life of the agreement.

Investments for which the equity method or historical cost method of accounting are used are recorded in

other assets on the consolidated balance sheet. MasterCard’s share of net earnings or losses of entities accounted

95