MasterCard 2012 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2012 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Valuation of Assets

The valuation of assets acquired in a business combination and asset impairment reviews require the use of

significant estimates and assumptions. The acquisition method of accounting for business combinations requires

the Company to estimate the fair value of assets acquired, liabilities assumed, and any non-controlling interest in

the acquiree to properly allocate purchase price consideration between assets that are depreciated and amortized

from goodwill. Impairment testing for assets, other than goodwill and indefinite-lived intangible assets, requires

the allocation of cash flows to those assets or group of assets and if required, an estimate of fair value for the

assets or group of assets. The Company’s estimates are based upon assumptions believed to be reasonable, but

which are inherently uncertain and unpredictable. These valuations require the use of management’s

assumptions, which would not reflect unanticipated events and circumstances that may occur.

We evaluate goodwill and indefinite-lived intangible assets for impairment on an annual basis or sooner if

indicators of impairment exist. In the fourth quarter of 2012, the Company early adopted new Financial

Accounting Standards Board (FASB) guidance that simplifies how an entity tests indefinite-lived intangible

assets for impairment, allowing a qualitative assessment to be performed, which is similar to the FASB guidance

for evaluating goodwill for impairment. In performing these qualitative assessments, we consider relevant events

and conditions, including but not limited to, macroeconomic trends, industry and market conditions, overall

financial performance, cost factors, company-specific events, legal and regulatory factors and the Company’s

market capitalization. If the qualitative assessments indicate that it is more likely than not that the fair value of

the reporting unit or indefinite-lived intangible assets are less than their carrying amounts, the Company must

perform a quantitative impairment test. After performing the annual goodwill and indefinite-lived intangible asset

impairment qualitative reviews during the fourth quarter of 2012, the Company determined it was not necessary

to perform a quantitative impairment test for goodwill or indefinite-lived intangible assets.

Item 7A. Quantitative and Qualitative Disclosures About Market Risk

Market risk is the potential for economic losses to be incurred on market risk sensitive instruments arising

from adverse changes in market factors such as interest rates, foreign currency exchange rates and equity price

risk. Our exposure to market risk from changes in interest rates, foreign exchange rates and equity price risk is

limited. Management establishes and oversees the implementation of policies governing our funding, investments

and use of derivative financial instruments. We monitor risk exposures on an ongoing basis. The effect of a

hypothetical 10% adverse change in foreign currency rates could result in a fair value loss of approximately $166

million on our foreign currency derivative contracts outstanding at December 31, 2012 related to the hedging

program. A 100 basis point adverse change in interest rates would not have a material impact on the Company’s

financial assets or liabilities at December 31, 2012 and 2011. In addition, there was no material equity price risk

at December 31, 2012 or 2011. The Dodd-Frank Act includes provisions related to derivative financial

instruments and the Company is determining what impact, if any, such provisions will have on the Company’s

financial position or results of operations.

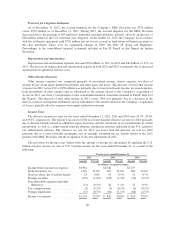

Foreign Exchange Risk

We enter into forward contracts to manage foreign exchange risk associated with anticipated receipts and

disbursements which are either transacted in a non-functional currency or valued based on a currency other than

our functional currencies. We also enter into forward contracts to offset possible changes in value due to foreign

exchange fluctuations of assets and liabilities denominated in currencies other than the functional currency of the

entity holding the assets and liabilities. The objective of this activity is to reduce our exposure to transaction

gains and losses resulting from fluctuations of foreign currencies against our functional currencies, principally

the U.S. dollar and euro. The notional value of commitments to sell foreign currency increased to $1.6 billion at

December 31, 2012 compared to $279 million at December 31, 2011 due to the hedging of an increase in assets

denominated in a currency other than the functional currency of the entity holding the assets and an expanded

hedging program to offset the Company’s foreign currency exposures arising from anticipated receipts and

disbursements. The terms of the forward contracts are generally less than 18 months.

67