MasterCard 2012 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2012 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.online and on tablets and mobile devices. We can also help merchants improve efficiencies with solutions such as

our contactless technology and our internet payment gateways. Merchants can address fraud concerns with fraud

detection and prevention solutions like our Expert Monitoring System. Finally, we provide merchant forums and

anti-piracy programs to inform, educate and share information with merchants on topics that are relevant to them

such as fraud.

Despite these opportunities, we also face challenges in our relationships with merchants. We believe that

consolidation in the retail industry is producing a set of larger merchants with increasingly global scope. These

merchants are having a significant impact on all participants in the global payments industry, including

MasterCard. In particular, large merchants have supported many of the litigation, legislative and regulatory

challenges related to interchange fees that MasterCard and others in the industry have been defending against.

This includes the U.S. merchant litigations as to which the Company recently entered into a settlement agreement

(subject to final court approval). See our risk factor in “Risk Factors—Legal and Regulatory Risks” in Part I,

Item 1A of this Report related to merchants’ continued focus on the costs of accepting electronic forms of

payment.

Governments. We work closely with national, state and local governments (including regulators and

agencies) around the world to not only help shape payments regulation, but to work together strategically with

governments to help them provide safe, efficient and transparent ways to serve their payment needs and that of

their people. We provide governments with solutions that help them reduce costs, gain efficiencies, curtail fraud

and corruption and advance social programs. We work with governments to reduce costs by providing electronic

payment solutions that save the expense of producing, managing and disbursing currency. In addition, we help

drive government efficiency by providing ways to eliminate paper systems, implement identification solutions,

manage social payments, improve procurement (through travel and entertainment, procurement cards and

purchasing payment automation) and deploy improved transit payment options (using chip and our contactless

technology). We also work with governments to provide them with more efficient ways to deliver social benefits

(including through prepaid cards), as well as products and solutions to help reduce errors and curtail fraud. Our

products and programs can help governments drive financial inclusion by providing initial or improved access to

financial services for the underbanked. We work with governments to provide payment solutions such as

reloadable, prepaid or debit payroll or other social benefit cards (including cards to aid victims of natural

disasters) and products and solutions that enable mobile commerce payments.

MasterCard Revenue Sources

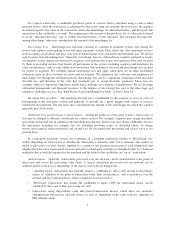

We generate revenues by charging fees to our customers for providing transaction processing and other

payment-related services and assessing our customers based on GDV on the cards and other devices that carry

our brands. Accordingly, our revenues are impacted both by the number of transactions that we process and by

the use of cards and other devices carrying our brands. Our net revenues are classified into the following five

categories:

•Domestic assessments: Domestic assessments are fees charged to issuers and acquirers based

primarily on the volume of activity on cards and other devices that carry our brands where the merchant

country and the issuer country are the same.

•Cross-border volume fees: Cross-border volume fees are charged to issuers and acquirers based on the

volume of activity on cards and other devices that carry our brands where the merchant country and

issuer country are different.

•Transaction processing fees: Transaction processing fees are charged for both domestic and cross-

border transactions and are primarily based on the number of transactions.

•Other revenues: Other revenues for other payment-related services include fees associated with fraud

products and services, cardholder service fees, consulting and research fees, program management

service fees and a variety of other payment-related services.

16