MasterCard 2012 Annual Report Download - page 11

Download and view the complete annual report

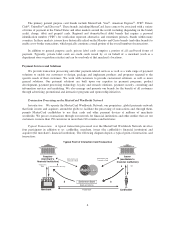

Please find page 11 of the 2012 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In a typical transaction, a cardholder purchases goods or services from a merchant using a card or other

payment device. After the transaction is authorized by the issuer using our network, the issuer pays the acquirer

an amount equal to the value of the transaction, minus the interchange fee (described below), and then posts the

transaction to the cardholder’s account. The acquirer pays the amount of the purchase, net of a discount (referred

to as the “merchant discount” rate, as further described below), to the merchant. The merchant discount rate,

among other things, takes into consideration the amount of the interchange fee.

Interchange Fees. Interchange fees represent a sharing of a portion of payments system costs among the

issuers and acquirers participating in our four-party payments system. They reflect the value merchants receive

from accepting our products and play a key role in balancing the costs consumers and merchants pay. We do not

earn revenues from interchange fees. Generally, interchange fees are collected from acquirers and paid to issuers

(or netted by issuers against amounts paid to acquirers) to reimburse the issuers for a portion of the costs incurred

by them in providing services that benefit all participants in the system, including acquirers and merchants. In

some circumstances, such as cash withdrawal transactions, this situation is reversed and interchange fees are paid

by issuers to acquirers. We establish default interchange fees that apply when there are no other established

settlement terms in place between an issuer and an acquirer. We administer the collection and remittance of

interchange fees through the settlement process. Interchange fees can be a significant component of the merchant

discount rate, and therefore of the costs that merchants pay to accept electronic payments. These fees are

currently subject to regulatory, legislative and/or legal challenges in a number of jurisdictions. We are devoting

substantial management and financial resources to the defense of interchange fees and to the other legal and

regulatory challenges we face. See “Risk Factors-Legal and Regulatory Risks” in Part I, Item 1A.

Merchant Discount Rate. The merchant discount rate is established by the acquirer to cover its costs of

participating in the four-party system and generally to provide for a profit margin with respect to services

rendered to the merchant. The rate takes into consideration the amount of the interchange fee which the acquirer

generally pays to the issuer.

Additional Fees and Economic Considerations. Among the parties in a four-party system, various types of

fees may be charged to different constituents for various services. For example, acquirers may charge merchants

processing and related fees in addition to the merchant discount rate. Issuers may also charge cardholders fees for

the transaction, including, for example, fees for extending revolving credit. As described below, we charge

issuers and acquirers transaction-based and related fees for the transaction processing and related services we

provide them.

In a four-party payments system, the economics of a payment transaction relative to MasterCard vary

widely depending on such factors as whether the transaction is domestic (and, if it is domestic, the country in

which it takes place) or cross-border, whether it is a point-of-sale purchase transaction or cash withdrawal, and

whether the transaction is processed over our network or a third-party network or is handled solely by a financial

institution that is both the acquirer for the merchant and the issuer to the cardholder (an “on-us” transaction).

Authentication. Generally, transactions processed over our network can be authenticated at the point of

interaction and across the processing value chain. A typical transaction processed over our network can be

authenticated in several ways (depending on the type of card or device being used):

• “signature-based” transactions that typically require a cardholder to sign a sales receipt as the primary

means of validation at the point of interaction (other than circumstances, such as purchases over the

internet and low-value purchases, where a signature is not necessary);

• “PIN-based” transactions that require the cardholder to input a PIN for verification which can be

validated by the issuer at their processing site; and

• transactions using chip-enabled cards and point-of-interaction devices which allow for automatic

authentication between the card and device (as well as, depending on the card or device, signature or

PIN authentication).

7