MasterCard 2012 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2012 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

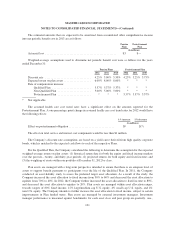

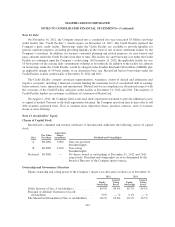

The Company evaluated the estimated impairment of its ARS portfolio to determine if it was other-than-

temporary. The Company considered several factors including, but not limited to, the following: (1) the reasons

for the decline in value (changes in interest rates, credit event, or market fluctuations); (2) assessments as to

whether it is more likely than not that it will hold and not be required to sell the investments for a sufficient

period of time to allow for recovery of the cost basis; (3) whether the decline is substantial; and (4) the historical

and anticipated duration of the events causing the decline in value. The evaluation for other-than-temporary

impairments is a quantitative and qualitative process, which is subject to various risks and uncertainties. The

risks and uncertainties include changes in credit quality, market liquidity, timing and amounts of issuer calls, and

interest rates. The securities are fully collateralized by student loans with guarantees (ranging from

approximately 95% to 98% of principal and interest) by the U.S. government via the Department of Education.

As of December 31, 2012, the Company believed that the unrealized losses on the ARS were not related to credit

quality but rather due to the lack of liquidity in the market. The Company believes that it is more likely than not

that the Company will hold and not be required to sell its ARS investments until recovery of their cost basis

which may be at maturity or earlier if called. Therefore, MasterCard does not consider the unrealized losses to be

other-than-temporary. The Company estimated a 10% discount to the par value of the ARS portfolio at

December 31, 2012 and 2011. The pre-tax impairment included in accumulated other comprehensive income

related to the Company’s ARS was $3 million and $8 million as of December 31, 2012 and 2011, respectively. A

hypothetical increase of 100 basis points in the discount rate used in the discounted cash flow analysis would

have increased the impairment by $2 million and $3 million at December 31, 2012 and 2011, respectively.

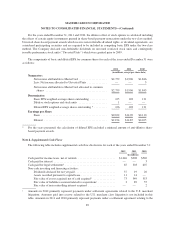

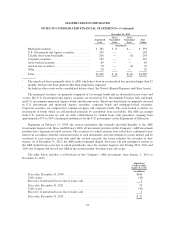

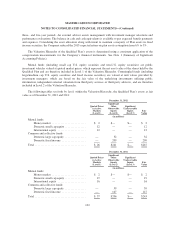

Investment Maturities:

The maturity distribution based on the contractual terms of the Company’s investment securities at

December 31, 2012 was as follows:

Available-For-Sale

Amortized

Cost Fair Value

(in millions)

Due within 1 year ................................................ $1,418 $1,418

Due after 1 year through 5 years .................................... 1,254 1,263

Due after 5 years through 10 years .................................. 59 60

Due after 10 years ............................................... 35 32

No contractual maturity ........................................... 209 210

Total .......................................................... $2,975 $2,983

All the securities due after ten years are ARS. Taxable short-term bond funds have been included in the

table above in the no contractual maturity category, as these investments do not have a stated maturity date;

however, the short-term bond funds have daily liquidity.

94