MasterCard 2012 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2012 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MASTERCARD INCORPORATED

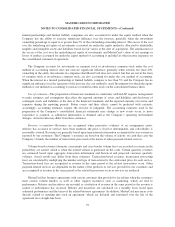

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

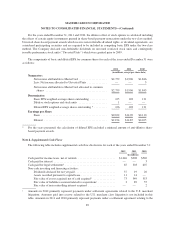

Treasury stock—The Company records the repurchase of shares of common stock at cost based on the

settlement date of the transaction. These shares are considered treasury stock, which is a reduction to

stockholders’ equity. Treasury stock is included in authorized and issued shares but excluded from outstanding

shares.

Property, plant and equipment—Property, plant and equipment are stated at cost less accumulated

depreciation and amortization. Depreciation of equipment and furniture and fixtures is computed using the

straight-line method over the related estimated useful lives of the assets, generally ranging from two to five

years. Amortization of leasehold improvements is generally computed using the straight-line method over the

lesser of the estimated useful lives of the improvements or the terms of the related leases. Capital leases are

amortized using the straight-line method over the lives of the leases. Depreciation on buildings is calculated

using the straight-line method over an estimated useful life of 30 years. Amortization of leasehold improvements

and capital leases is included in depreciation expense.

Leases—The Company enters into operating and capital leases for the use of premises, software and

equipment. Rent expense related to lease agreements which contain lease incentives is recorded on a straight-line

basis over the term of the lease.

Pension and other postretirement plans—The Company recognizes the overfunded or underfunded status of

its single-employer defined benefit plan or postretirement plan as an asset or liability in its balance sheet and

recognizes changes in the funded status in the year in which the changes occur through other comprehensive

income. The funded status is measured as the difference between the fair value of plan assets and the benefit

obligation at December 31, the measurement date. The fair value of plan assets represents the current market

value of the pension assets. Overfunded plans are aggregated and recorded in long-term other assets, while

underfunded plans are aggregated and recorded as accrued expenses and long-term other liabilities.

Net periodic pension and postretirement benefit cost/(income) is recognized in general and administrative

expenses in the consolidated statement of operations. These costs include service costs, interest cost, expected

return on plan assets, amortization of prior service costs or credits and gains or losses previously recognized as a

component of other comprehensive income or loss. See Note 11 (Pension Plans, Postretirement Plan, Savings

Plan and Other Benefits) for information about methods and assumptions.

Defined contribution savings plans—The Company’s contributions to defined contribution savings plans are

recorded when the employee renders service to the Company. The charge is recorded in general and

administrative expenses.

Share based payments—The Company recognizes the fair value of all share based payments to employees

in its financial statements. The Company measures share based compensation expense at the grant date, based on

the estimated fair value of the award and uses the straight-line method of attribution, net of estimated forfeitures,

for expensing awards over the employee requisite service period. The Company estimates the fair value of stock

option awards using a Black-Scholes valuation model. The fair value of Restricted Stock Units (RSUs), including

Performance Stock Units (PSUs), is determined and fixed on the grant date based on the Company’s stock price,

adjusted for the exclusion of dividend equivalents. All share based compensation expenses are recorded in

general and administrative expenses.

The Company recognizes a realized tax benefit associated with dividends on certain equity shares and

options as an increase to additional paid-in capital. The benefit is included in the pool of excess tax benefits

available to absorb potential future tax liabilities on share based payment awards.

84