MasterCard 2012 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2012 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MasterCard’s financial results may be negatively impacted by actions taken by individual financial

institutions or by governmental or regulatory bodies. The condition of the economic environments may

accelerate the timing of or increase the impact of risks to our financial performance. As a result, our revenue may

be negatively impacted, or the Company may be impacted in several ways. MasterCard continues to monitor the

extent and pace of economic recovery around the world to identify opportunities for the continued growth of our

business and to evaluate the evolution of the global payments industry. For example, in our Asia Pacific and

Latin American regions, we continue to see significant increases in dollar volume of activity on cards carrying

our brands in those regions while in the United States and Europe we have experienced growth in dollar volume

despite mixed economic indicators. Notwithstanding recent encouraging trends, the extent and pace of economic

recovery in various regions remains uncertain and the overall business environment may present challenges for

MasterCard to grow its business. For a full discussion see “Risk Factors—Business Risk” in Part I, Item 1A of

this Report.

In addition, our business and our customers’ businesses are subject to regulation in many countries.

Regulatory bodies may seek to impose rules and price controls on certain aspects of our business and the

payments industry. See Note 18 (Legal and Regulatory Proceedings) to the consolidated financial statements

included in Part II, Item 8 and our risk factor in “Risk Factors—Legal and Regulatory Risks” in Part I, Item 1A

of this Report for further discussion. Further, information security risks for global payments and technology

companies such as MasterCard have significantly increased in recent years. Although to date we have not

experienced any material impacts relating to cyber-attacks or other information security breaches, there can be no

assurance that we will be immune to these risks and not suffer such losses in the future. See our risk factor in

“Risk Factors—Business Risks” in Part I, Item 1A of this Report related to a failure or breach of our security

systems or infrastructure as a result of cyber-attacks.

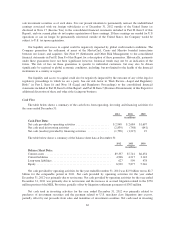

Impact of Foreign Currency Rates

Our overall operating results are impacted by changes in foreign currency exchange rates, especially the

strengthening or weakening of the U.S. dollar versus the euro and Brazilian real. The functional currency of

MasterCard Europe, our principal European operating subsidiary, is the euro, and the functional currency of our

Brazilian subsidiary is the Brazilian real. Accordingly, the strengthening or weakening of the U.S. dollar versus

the euro and Brazilian real impacts the translation of our European and Brazilian subsidiaries’ operating results

into the U.S. dollar. For 2012 as compared to 2011, the US dollar strengthened against both the euro and the

Brazilian real. For 2011 compared to 2010, the U.S. dollar weakened against both the euro and the Brazilian real.

Accordingly, the net foreign currency impact of changes in the U.S. dollar average exchange rates against the

euro and Brazilian real decreased net income in 2012 compared to 2011 by 7 percentage points. Conversely, net

income in 2011 was positively impacted by currency by approximately 2 percentage points.

In addition, changes in foreign currency exchange rates directly impact the calculation of GDV and gross

euro volume (“GEV”), which are used in the calculation of our domestic assessments, cross-border volume fees

and volume related rebates and incentives. In most non-European regions, GDV is calculated based on local

currency spending volume converted to U.S. dollars using average exchange rates for the period. In Europe, GEV

is calculated based on local currency spending volume converted to euros using average exchange rates for the

period. As a result, our domestic assessments, cross-border volume fees and volume related rebates and

incentives are impacted by the strengthening or weakening of the U.S. dollar versus primarily non-European

local currencies and the strengthening or weakening of the euro versus primarily European local currencies. The

strengthening or weakening of the U.S. dollar is evident when GDV growth on a U.S. dollar converted basis is

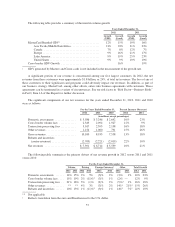

compared to GDV growth on a local currency basis. In 2012, GDV on a U.S. dollar converted basis increased

12%, versus GDV growth on a local currency basis of 15%. In 2011, GDV on a U.S. dollar converted basis

increased 19%, versus GDV growth on a local currency basis of 16%. The Company attempts to manage these

foreign currency exposures through its foreign exchange risk management activities, which are discussed further

in Note 20 (Foreign Exchange Risk Management) to the consolidated financial statements included in Part II,

Item 8 of this Report.

53