MasterCard 2012 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2012 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

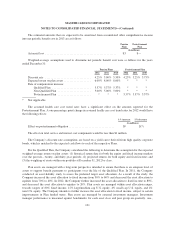

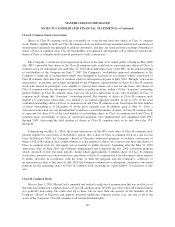

Whether or not the PSUs are granted will be based upon MasterCard’s performance against a predetermined

return on equity goal, with an average of return on equity over the three-year period commencing on January 1 of

the grant year, yielding threshold, target or maximum performance, with a potential adjustment determined at the

discretion of the MasterCard Human Resources and Compensation Committee of the Board of Directors using

subjective quantitative and qualitative goals that are established at the beginning of each year in the performance

period. These goals are expected to include MasterCard performance against internal management metrics and

external relative metrics. The 2012, 2011 and 2010 grant years beginning January 1 have a performance period

ending December 2014, 2013 and 2012, respectively.

These PSUs have been classified as equity awards, will be settled by delivering stock to the employees and

contain service and performance conditions. The initial fair value of each PSU is the closing price on the New

York Stock Exchange of the Company’s Class A common stock on the date of issuance. Given that the

performance terms are subjective and not fixed on the date of issuance, the PSUs will be remeasured at the end of

each reporting period, at fair value, until the time the performance conditions are fixed and the ultimate number

of shares to be issued is determined. Estimates are adjusted as appropriate. Compensation expense is calculated

using the number of PSUs expected to vest, multiplied by the period ending price of a share of MasterCard’s

Class A common stock on the New York Stock Exchange, less previously recorded compensation expense.

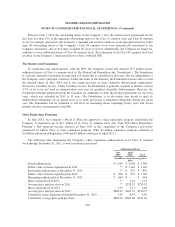

With regard to the PSUs issued in 2009, the Company awarded 143% of the original number of shares

issued based on the Company’s performance against a predetermined return on equity goal, with an average

return on equity per year over the three-year period commencing January 1, 2009 and ending December 31,

2011. The grant-date fair value for each PSU was $343.

With regard to the PSUs issued in 2010, the Company expects to award 138% of the original number of

shares issued based on the Company’s performance against a predetermined return on equity goal, with an

average return on equity per year over the three-year period commencing January 1, 2010 and ending

December 31, 2012. The grant-date fair value for each PSU is $518.

In 2012, 2011 and 2010, 64 thousand, 381 thousand and 550 thousand PSUs, respectively, were converted

into shares of Class A common stock. The total intrinsic value of PSUs converted into shares of Class A common

stock during the years ended December 31, 2012, 2011 and 2010, was $27 million, $93 million and $123 million,

respectively.

As of December 31, 2012, there was $8 million of total unrecognized compensation cost related to non-

vested PSUs. The cost is expected to be recognized over a weighted-average period of 1.6 years.

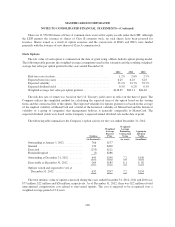

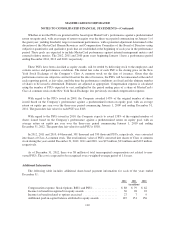

Additional Information

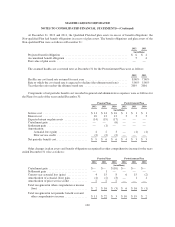

The following table includes additional share-based payment information for each of the years ended

December 31:

2012 2011 2010

(in millions)

Compensation expense: Stock Options, RSUs and PSUs ................. $ 88 $ 79 $ 62

Income tax benefit recognized for equity awards ....................... 30 28 22

Income tax benefit related to options exercised ........................ 27 7 9

Additional paid-in-capital balance attributed to equity awards ............ 187 151 156

110