MasterCard 2012 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2012 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.around the world, including financial institutions, retailers, travel agents and foreign exchange

bureaus. Combined with MasterCard’s processing assets (such as IPS) and other strategic alliances, these

services augment and support issuers of prepaid cards around the world, with a focus outside of the United

States. Access enables us to offer end-to-end prepaid solutions encompassing branded switching, issuer

processing and program management services, primarily focused on the travel sector.

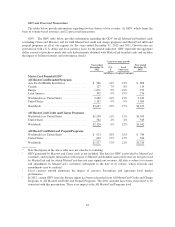

Commercial. We offer commercial payment solutions that help large corporations, mid-sized companies,

small businesses and government entities to streamline their procurement and payment processes, manage

information and expenses and reduce administrative costs. For the year ended December 31, 2012, our

commercial credit and charge programs generated $287 billion in GDV globally, representing 8% of our total

GDV for this period. As of December 31, 2012, the MasterCard brand mark appeared on 36 million commercial

credit and charge cards worldwide, representing an 8% increase from December 31, 2011. We offer various

commercial payment programs and value-added services, including corporate cards, corporate premium cards,

corporate purchasing cards and fleet cards (as well as the MasterCard Corporate Multi Card®, which combines

the functionality of one or more of these cards) that allow corporations to, among other things, manage travel and

entertainment expenses, streamline the procurement process and provide corporations with additional

transactional detail. Among the platforms we provide is SmartData, a MasterCard-powered tool which provides

information reporting and expense management capabilities. We also offer government entities a variety of

payment programs that are similar to the procurement, travel, purchasing, fleet and Multi Card programs offered

to corporations. Credit and debit programs targeted at the small-business segment offer business owners the

ability to gain access to working capital, to extend payments and to separate business expenses from personal

expenses.

Emerging Payments and Innovation. We focus on innovation to enhance our current programs and extend

our products and services to customers (including merchants, telecommunications companies and government

entities) and into new geographies. We have a global innovation group, MasterCard Labs, which is dedicated to

developing new and innovative products and solutions for our customers and our cardholders. This group

incubates new product concepts, builds prototypes, runs pilots and is designed for a rapid evaluation process.

We offer innovative platforms, services and technologies aligned around the following strategic areas:

•Digital Infrastructure. The continued adoption of connected devices (such as mobile smartphones,

PCs, and tablet devices) has resulted in the ongoing convergence of the physical and digital worlds,

where consumers are increasingly transacting across a range of connected devices in a variety of

contexts—in-store, online and on tablets and mobile devices. To support this convergence, we have

developed a digital platform that is designed to allow customers, merchants and others to provide a

consistent, fast and secure shopping experience for consumers, whether at a register, or on a PC, tablet

or mobile device. The platform is also focused on generating more value and increased sales for

merchants (including building preference and loyalty), and delivering new revenue streams and

competitive advantages for MasterCard and our customers. We also work with strategic partners to

enable consumers to securely use their smartphones to make contactless payments and obtain other

related services. We have worked with multiple customers globally to launch digital wallet solutions

powered by our mobile contactless technology. In addition, we are supporting the pilot launch of ISIS (a

joint venture formed in the United States by AT&T, Verizon and T-Mobile). Also, in December 2012,

we made a minority investment in C-SAM, a global mobile wallet software provider.

•Mobile Money Infrastructure. We provide a platform and various services to customers and other

parties to enable consumers to pay from any type of mobile phone (and in particular, feature phones).

These services include linking mobile accounts to virtual MasterCard account numbers, allowing

subscribers (many of whom do not have traditional payment cards) to shop online, enabling person-to-

person transfers (including our money transfer solution, MasterCard MoneySend®) on behalf of our

customers for consumers using mobile devices, and enabling mobile subscribers to send payments to

handsets of merchants who otherwise do not accept electronic payments. Mobile Money services are

12