MasterCard 2012 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2012 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

Comprehensive income—In June 2011, new accounting guidance was issued by the FASB that amends

existing guidance by allowing only two options for presenting the components of net income and other

comprehensive income: (1) in a single continuous statement of comprehensive income or (2) in two separate but

consecutive financial statements, consisting of an income statement followed by a separate statement of

comprehensive income. Also, items that are reclassified from accumulated other comprehensive income to net

income must be presented on the face of the financial statements. In December 2011, new accounting guidance

was issued that indefinitely defers the effective date for the requirement to present the reclassification of items

from other comprehensive income to net income. The guidance requires retrospective application, and is

effective for fiscal years, and interim periods within those years, beginning after December 15, 2011, with early

adoption permitted. The Company adopted the revised accounting guidance effective January 1, 2012, and the

adoption had a limited impact on the Company’s financial disclosures. In February 2013, new accounting

guidance was issued by the FASB that will require disclosure of amounts reclassified from accumulated other

comprehensive income to net income. The Company will adopt the revised accounting guidance effective

January 1, 2013, and anticipates that this adoption will have limited impact on the Company’s disclosures.

Impairment testing for indefinite-lived intangible assets—In July 2012, new accounting guidance was issued

by the FASB that is intended to simplify how an entity tests indefinite-lived intangible assets for impairment.

Under this guidance, an entity has the option to first assess qualitative factors to determine whether the existence

of events or circumstances indicate that it is more likely than not that the indefinite-lived intangible asset is

impaired. If, after assessing the totality of events or circumstances, an entity concludes that the indefinite-lived

intangible asset is not more likely than not impaired, then the entity would not be required to take further action.

However, if an entity concludes otherwise, then it would be required to determine the fair value of the indefinite-

lived intangible asset and compare the fair value with the carrying amount. An entity also would have the option

to bypass the qualitative assessment for any indefinite-lived intangible asset in any period and proceed directly to

calculating its fair value. The amendments are effective for annual and interim impairment tests performed for

fiscal years beginning after September 15, 2012, with early adoption permitted. The Company adopted the

revised accounting guidance October 1, 2012, and the adoption did not have an impact on the Company’s

financial position or results of operations.

Balance Sheet Offsetting—In January 2013, the FASB issued accounting guidance clarifying the scope of its

previously issued requirements to disclose gross and net amounts of eligible financial assets and financial

liabilities recognized on the balance sheet. The guidance is effective for annual reporting periods beginning after

January 1, 2013, and interim periods within those annual periods. The Company will adopt the revised

accounting guidance effective January 1, 2013, and anticipates that this adoption will have limited impact on the

Company’s disclosures.

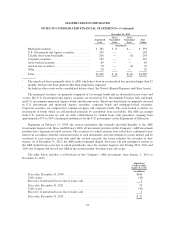

Note 2. Acquisitions

2012 Acquisitions

In 2012, the Company completed three acquisitions for an aggregate cost of $70 million. The excess of

purchase consideration over net assets acquired of $48 million was recorded as goodwill. None of the goodwill is

expected to be deductible for local tax purposes.

2011 Acquisition

Card Program Management Operations

On December 9, 2010, MasterCard entered into an agreement to acquire the prepaid card program

management operations of Travelex Holdings Ltd., since renamed Access Prepaid Worldwide (“Access”).

Pursuant to the terms of the acquisition agreement, the Company acquired Access on April 15, 2011, at a

86