MasterCard 2012 Annual Report Download - page 58

Download and view the complete annual report

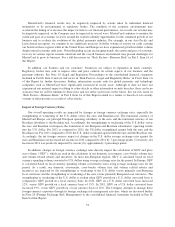

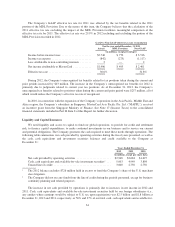

Please find page 58 of the 2012 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The Company generates revenues and has financial assets in countries at risk for currency devaluation.

While these revenues and financial assets are not material to MasterCard on a consolidated basis, they could be

negatively impacted if a devaluation of local currencies occurs relative to the U.S. dollar.

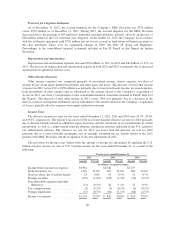

Acquisitions

On April 15, 2011, MasterCard acquired the prepaid card program management operations of Travelex

Holdings Ltd., since renamed Access Prepaid Worldwide (“Access”), at a purchase price of 295 million U.K.

pound sterling, or $481 million, including adjustments for working capital, with contingent consideration (an

“earn-out”) of up to an additional 35 million U.K. pound sterling, or approximately $57 million, if certain

performance targets were met. See Note 2 (Acquisitions) to the consolidated financial statements included in Part

II, Item 8 of this Report. Through Access, MasterCard manages and delivers consumer and corporate prepaid

travel cards through business partners around the world, including financial institutions, retailers, travel agents

and foreign exchange bureaus. Access has enabled MasterCard to offer end-to-end prepaid card solutions

encompassing branded switching, issuer processing and program management services, primarily focused on the

travel sector and in markets outside the United States.

On October 22, 2010, MasterCard acquired all the outstanding shares of DataCash Group plc (“DataCash”),

a payment service provider with operations in Europe and Brazil, at a purchase price of 334 million U.K. pound

sterling, or $534 million. DataCash provides e-commerce merchants with the ability to process secure payments

across the world. DataCash develops and provides outsourced electronic payments solutions, fraud prevention,

alternative payment options, back-office reconciliation and solutions for merchants selling via multiple channels.

MasterCard believes the acquisition of DataCash creates a long-term growth platform in the e-commerce

category while enhancing existing MasterCard payment products and expanding its global presence in the

internet gateway business.

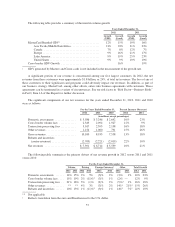

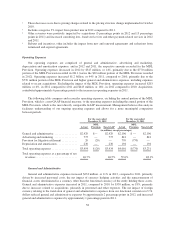

Financial Results

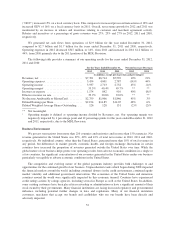

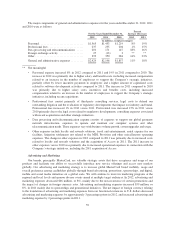

Revenues

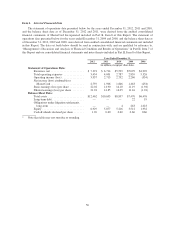

Revenue Description

MasterCard’s business model involves four participants in addition to us: cardholders, merchants, issuers

(the cardholders’ financial institutions) and acquirers (the merchants’ financial institutions). Our gross revenues

are typically based on the volume of activity on cards and other devices that carry our brands, the number of

transactions we process for our customers or the nature of other payment-related services we provide to our

customers. Our revenues are based upon transactional information accumulated by our systems or reported by

our customers. Our primary revenue billing currencies are the U.S. dollar, euro and Brazilian real.

Our pricing is complex and is dependent on the nature of the volumes, types of transactions and other

products and services we offer to our customers. The following factors impact pricing:

• Domestic or cross-border

• Signature-based (credit and debit) or PIN-based (debit, including automated teller machine (“ATM”)

cash withdrawals and retail purchases)

• Tiered rates that fluctuate based on volume/transaction hurdles

• Geographic region or country

• Retail purchase or cash withdrawal

• Processed or not processed by MasterCard

54