MasterCard 2012 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2012 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

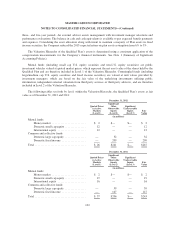

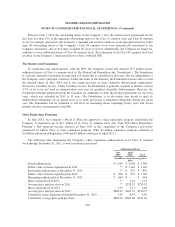

There are 11,550,000 shares of Class A common stock reserved for equity awards under the LTIP. Although

the LTIP permits the issuance of shares of Class B common stock, no such shares have been reserved for

issuance. Shares issued as a result of option exercises and the conversions of RSUs and PSUs were funded

primarily with the issuance of new shares of Class A common stock.

Stock Options

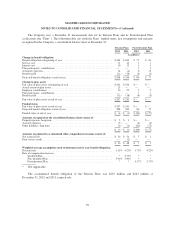

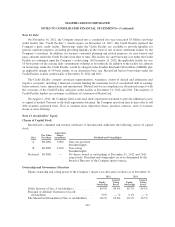

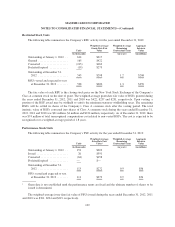

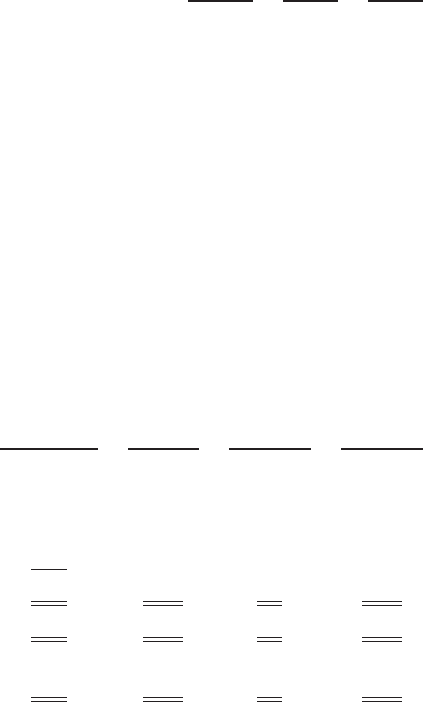

The fair value of each option is estimated on the date of grant using a Black-Scholes option pricing model.

The following table presents the weighted-average assumptions used in the valuation and the resulting weighted-

average fair value per option granted for the years ended December 31:

2012 2011 2010

Risk-free rate of return ...................................... 1.2% 2.6% 2.7%

Expected term (in years) .................................... 6.25 6.25 6.25

Expected volatility ......................................... 35.2% 33.7% 32.7%

Expected dividend yield ..................................... 0.3% 0.2% 0.3%

Weighted-average fair value per option granted .................. $148.45 $89.11 $84.62

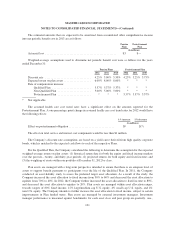

The risk-free rate of return was based on the U.S. Treasury yield curve in effect on the date of grant. The

Company utilizes the simplified method for calculating the expected term of the option based on the vesting

terms and the contractual life of the option. The expected volatility for options granted was based on the average

of the implied volatility of MasterCard and a blend of the historical volatility of MasterCard and the historical

volatility of a group of companies that management believes is generally comparable to MasterCard. The

expected dividend yields were based on the Company’s expected annual dividend rate on the date of grant.

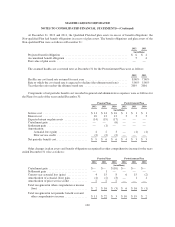

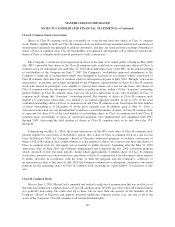

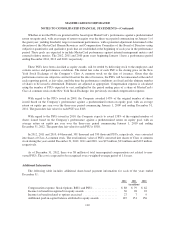

The following table summarizes the Company’s option activity for the year ended December 31, 2012:

Options

Weighted-

Average

Exercise

Price

Weighted-

Average

Remaining

Contractual

Term

Aggregate

Intrinsic

Value

(in thousands) (in years) (in millions)

Outstanding at January 1, 2012 ............ 766 $177

Granted ............................... 133 $420

Exercised .............................. (253) $121

Forfeited/expired ........................ (5) $286

Outstanding at December 31, 2012 ......... 641 $248 7.2 $156

Exercisable at December 31, 2012 .......... 269 $185 6.1 $ 82

Options vested and expected to vest at

December 31, 2012 .................... 632 $247 7.2 $154

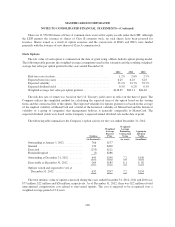

The total intrinsic value of options exercised during the years ended December 31, 2012, 2011 and 2010 was

$77 million, $22 million and $26 million, respectively. As of December 31, 2012, there was $22 million of total

unrecognized compensation cost related to non-vested options. The cost is expected to be recognized over a

weighted-average period of 2.6 years.

108