MasterCard 2012 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2012 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

On February 5, 2013, our Board of Directors declared a quarterly cash dividend of $0.60 per share payable

on May 9, 2013 to holders of record on April 9, 2013 of our Class A common stock and Class B common stock.

The aggregate amount of this dividend is estimated to be $74 million.

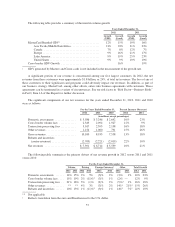

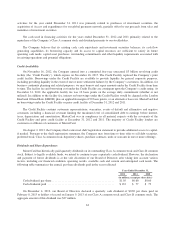

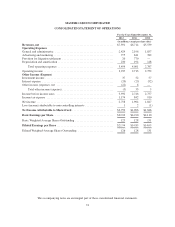

Shares in the Company’s common stock that are repurchased are considered treasury stock. The timing and

actual number of additional shares repurchased will depend on a variety of factors, including the operating needs

of the business, legal requirements, price, and economic and market conditions. The following table summarizes

the Company’s share repurchase authorizations of its Class A common stock through December 31, 2012, as well

as historical purchases:

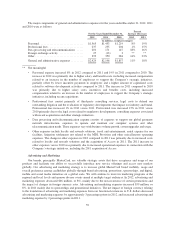

Authorization Dates

June 2012 April 20111Total

(in millions, except average price data)

Board authorization ..................................... $ 1,500 $ 2,000 $ 3,500

Remaining authorization at December 31, 2011............... ** $ 852 $ 852

Dollar-value of shares repurchased in 2012 .................. $ 896 $ 852 $ 1,748

Remaining authorization at December 31, 2012............... $ 604 $ — $ 604

Shares repurchased in 2012 .............................. 1.95 2.11 4.06

Average price paid per share in 2012 ....................... $460.22 $403.53 $430.71

** Not Applicable

1The initial authorization in September 2010 for $1 billion was amended in April 2011 to increase the

authorization to $2 billion.

As of January 25, 2013, the cumulative repurchases by the Company under the June 2012 Share Repurchase

Program totaled approximately 2.3 million shares of its Class A common stock for an aggregate cost of

approximately $1.1 billion at an average price of $467.44 per share of Class A common stock.

On February 5, 2013, our Board of Directors approved a new share repurchase program authorizing the

Company to repurchase up to $2 billion of its Class A common stock. The new share repurchase program will

become effective at the completion of the Company’s June 2012 Share Repurchase Program.

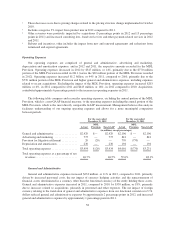

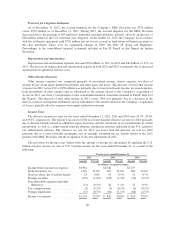

Off-Balance Sheet Arrangements

MasterCard has no off-balance sheet debt other than lease arrangements and other commitments as

presented in the Future Obligations table that follows.

Future Obligations

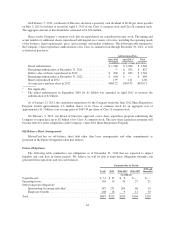

The following table summarizes our obligations as of December 31, 2012 that are expected to impact

liquidity and cash flow in future periods. We believe we will be able to fund these obligations through cash

generated from operations and our cash balances.

Payments Due by Period

Total42013 2014-2015 2016-2017

2018 and

thereafter

(in millions)

Capital leases1........................................ $ 51 $ 45 $ 6 $— $—

Operating leases ....................................... 103 19 36 27 21

Other long-term obligations2

Sponsorship, licensing and other3..................... 585 231 269 66 19

Employee benefits ................................. 108 18 9 11 70

Total ................................................ $847 $313 $320 $104 $110

64