MasterCard 2012 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2012 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Provision for Litigation Settlement

As of December 31, 2012, the accrued litigation for the Company’s MDL Provision was $726 million

versus $770 million as of December 31, 2011. During 2012, the accrued litigation for the MDL Provision

decreased due to the payment of $64 million to individual merchant plaintiffs, partially offset by an increase of

$20 million related to the U.S. merchant class litigation. On December 10, 2012, the Company (in accordance

with the settlement agreement) paid $726 million into an escrow account to fund future settlement payments to

the class merchants. There were no comparable charges in 2010. See Note 18 (Legal and Regulatory

Proceedings) to the consolidated financial statements included in Part II, Item 8 of this Report for further

discussion.

Depreciation and Amortization

Depreciation and amortization expenses increased $36 million, or 18%, in 2012 and $46 million, or 31%, in

2011. The increase in depreciation and amortization expense in both 2012 and 2011 is primarily due to increased

amortization of capitalized software costs.

Other Income (Expense)

Other income (expense) was comprised primarily of investment income, interest expense, our share of

income (losses) from equity method investments and other gains and losses. The decrease of total other income

(expense) in 2012 versus 2011 of $38 million was primarily due to lower investment income, increased expenses

from investments in joint ventures and an adjustment to the earnout related to the Company’s acquisition of

Access in 2011 (see Note 2 (Acquisitions) to the consolidated financial statements included in Part II, Item 8 of

this Report). The increase of total other income in 2011 versus 2010 was primarily due to a decrease in the

interest accretion on litigation settlements and an adjustment to the earnout related to the Company’s acquisition

of Access, partially offset by expenses from equity method investments.

Income Taxes

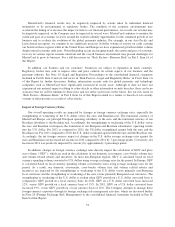

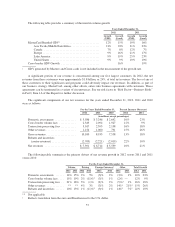

The effective income tax rates for the years ended December 31, 2012, 2011 and 2010 were 29.9%, 30.6%

and 33.0%, respectively. The effective tax rate for 2012 was lower than the effective tax rate for 2011 primarily

due to discrete benefits related to additional export incentives and the conclusion of tax examinations in certain

jurisdictions, as well as a larger benefit from the domestic production activities deduction in the U.S. related to

our authorization software. The effective tax rate for 2011 was lower than the effective tax rate for 2010

primarily due to a more favorable geographic mix of earnings, including the tax benefit related to the 2011

portion of the MDL Provision, and the recognition of discrete adjustments in 2011.

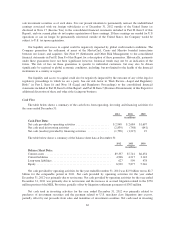

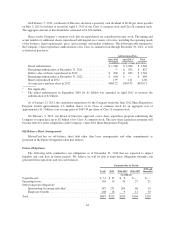

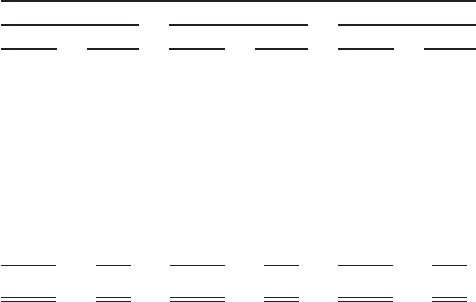

The provision for income taxes differs from the amount of income tax determined by applying the U.S.

federal statutory income tax rate of 35% to pretax income for the years ended December 31, as a result of the

following:

For the years ended December 31,

2012 2011 2010

Amount Percent Amount Percent Amount Percent

(in millions, except percentages)

Income before income tax expense .... $3,932 $2,746 $2,757

Federal statutory tax ................ 1,376 35.0% 961 35.0% 965 35.0%

State tax effect, net of federal benefit . . 23 0.6% 14 0.5% 19 0.7%

Foreign tax effect .................. (175) (4.4)% (133) (4.9)% (24) (0.9)%

Non-deductible expenses and other

differences ..................... (21) (0.5)% 34 1.2% 23 0.9%

Tax exempt income ................ (2) (0.1)% (3) (0.1)% (5) (0.2)%

Foreign repatriation ................ (27) (0.7)% (31) (1.1)% (68) (2.5)%

Income tax expense ................ $1,174 29.9% $ 842 30.6% $ 910 33.0%

60