MasterCard 2012 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2012 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

Advertising expense—The cost of media advertising is expensed when the advertising takes place.

Advertising production costs are expensed as incurred. Promotional items are expensed at the time the

promotional event occurs. Sponsorship costs are recognized over the period of benefit based on the estimated

value of certain events.

Foreign currency remeasurement and translation—For foreign currency remeasurement from each local

currency into the appropriate functional currency, monetary assets and liabilities are remeasured to functional

currencies using current exchange rates in effect at the balance sheet date. Non-monetary assets and liabilities are

recorded at historical exchange rates, and revenue and expense accounts are remeasured at a weighted-average

exchange rate for the period. Resulting exchange gains and losses related to remeasurement are included in

general and administrative expenses on the consolidated statement of operations.

Where a non-U.S. currency is the functional currency, translation from that functional currency to

U.S. dollars is performed for balance sheet accounts using current exchange rates in effect at the balance sheet

date and for revenue and expense accounts using a weighted-average exchange rate for the period. Resulting

translation adjustments are reported as a component of other comprehensive income (loss).

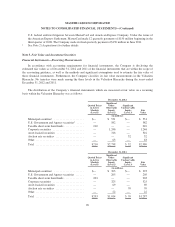

Earnings per share—The Company calculates earnings per share (EPS) by dividing net income attributable

to MasterCard by the weighted-average number of common shares outstanding during the year. Diluted EPS is

calculated by dividing net income attributable to MasterCard by the weighted-average number of common shares

outstanding during the year, adjusted for the potentially dilutive effect of stock options and unvested stock units

using the treasury stock method. For the years ended December 31, 2011 and 2010, EPS was calculated using the

two-class method. The two-class method clarifies that unvested share based payment awards that contain

nonforfeitable rights to dividends or dividend equivalents are considered participating securities and should be

included in the calculation of EPS. See Note 3 (Earnings Per Share) for further detail.

Recent accounting pronouncements

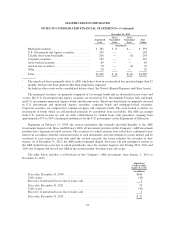

Fair value measurement and disclosure—In May 2011, the fair value accounting guidance was amended by

the FASB to change fair value measurement principles and disclosure requirements. The key changes in

measurement principles include limiting the concepts of highest and best use and valuation premise to

nonfinancial assets, providing a framework for considering whether a premium or discount can be applied in a

fair value measurement, and aligning the fair value measurement of instruments classified within an entity’s

shareholders’ equity with the guidance for liabilities. Disclosures are required for all transfers between Levels 1

and 2 within the Valuation Hierarchy, the use of a nonfinancial asset measured at fair value if its use differs from

its highest and best use, the level in the Valuation Hierarchy of assets and liabilities not recorded at fair value but

for which fair value is required to be disclosed, and for Level 3 measurements, quantitative information about

unobservable inputs used, a description of the valuation processes used, and qualitative discussion about the

sensitivity of the measurements. The Company adopted the revised accounting guidance effective January 1,

2012 via prospective adoption, as required, and the adoption did not have an impact on the Company’s financial

position or results of operations.

Impairment testing for goodwill—In September 2011, a new accounting guidance was issued that is

intended to simplify how an entity tests goodwill for impairment. Entities are permitted to perform a qualitative

assessment of goodwill impairment to determine whether it is necessary to perform the two-step quantitative

goodwill impairment test. This guidance is effective for goodwill impairment tests performed in interim and

annual periods for fiscal years beginning after December 15, 2011, with early adoption permitted. The Company

adopted the revised accounting guidance October 1, 2011. The adoption did not have an impact on the

Company’s financial position or results of operations.

85