MasterCard 2012 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2012 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

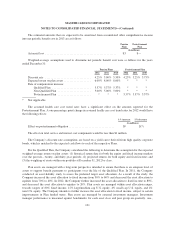

MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

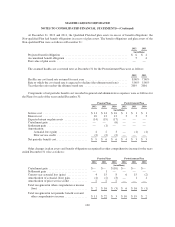

three-, and five-year periods. An external advisor assists management with investment manager selections and

performance evaluations. The balance in cash and cash equivalents is available to pay expected benefit payments

and expenses. Considering the asset allocation along with intent to maintain a majority of Plan assets in fixed

income securities, the Company reduced the 2013 expected return on plan assets assumption from 6% to 5%.

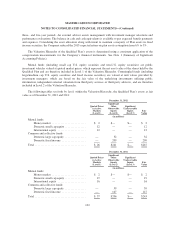

The Valuation Hierarchy of the Qualified Plan’s assets is determined using a consistent application of the

categorization measurements for the Company’s financial instruments. See Note 1 (Summary of Significant

Accounting Policies).

Mutual funds (including small cap U.S. equity securities and non-U.S. equity securities) are public

investment vehicles valued at quoted market prices, which represent the net asset value of the shares held by the

Qualified Plan and are therefore included in Level 1 of the Valuation Hierarchy. Commingled funds (including

large/medium cap U.S. equity securities and fixed income securities) are valued at unit values provided by

investment managers, which are based on the fair value of the underlying investments utilizing public

information, independent external valuation from third-party services or third-party advisors, and are therefore

included in Level 2 of the Valuation Hierarchy.

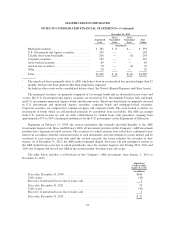

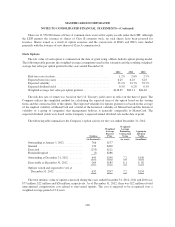

The following tables set forth by level, within the Valuation Hierarchy, the Qualified Plan’s assets at fair

value as of December 31, 2012 and 2011:

December 31, 2012

Quoted Prices

in Active

Markets

(Level 1)

Significant

Other

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Fair

Value

(in millions)

Mutual funds:

Money market ........................ $ 2 $— $— $ 2

Domestic small cap equity ............... 12 — — 12

International equity .................... 12 — — 12

Common and collective funds:

Domestic large cap equity ............... — 32 — 32

Domestic fixed income ................. — 209 — 209

Total .................................... $ 26 $241 $— $267

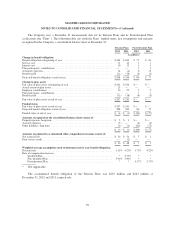

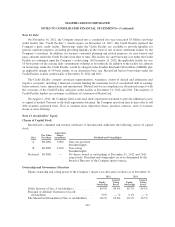

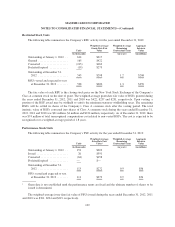

December 31, 2011

Quoted Prices

in Active

Markets

(Level 1)

Significant

Other

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Fair

Value

(in millions)

Mutual funds:

Money market ........................ $ 2 $— $— $ 2

Domestic small cap equity ............... 19 — — 19

International equity .................... 16 — — 16

Common and collective funds:

Domestic large cap equity ............... — 59 — 59

Domestic fixed income ................. — 147 — 147

Total .................................... $ 37 $206 $— $243

102