MasterCard 2012 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2012 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

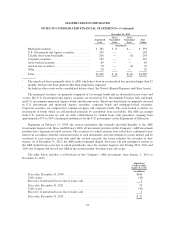

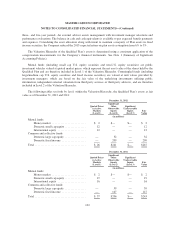

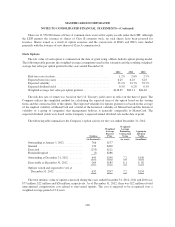

The estimated amounts that are expected to be amortized from accumulated other comprehensive income

into net periodic benefit cost in 2013 are as follows:

Pension

Plans

Postretirement

Plan

(in millions)

Actuarial loss .................................................. $3 $—

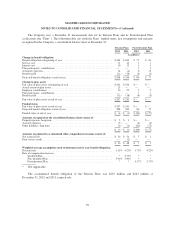

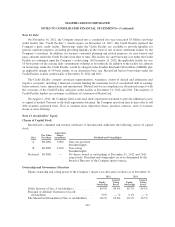

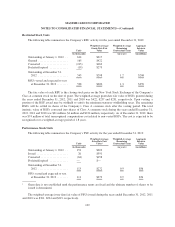

Weighted-average assumptions used to determine net periodic benefit cost were as follows for the years

ended December 31:

Pension Plans Postretirement Plan

2012 2011 2010 2012 2011 2010

Discount rate ................................ 4.25% 5.00% 5.50% 4.25% 5.25% 5.75%

Expected return on plan assets ................... 6.00% 8.00% 8.00% * * *

Rate of compensation increase:

Qualified Plan ........................... 5.37% 5.37% 5.37% * * *

Non-Qualified Plan ....................... 5.00% 5.00% 5.00% * * *

Postretirement Plan .......................***5.37% 5.37% 5.37%

* Not Applicable

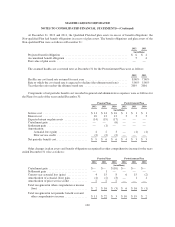

The assumed health care cost trend rates have a significant effect on the amounts reported for the

Postretirement Plan. A one-percentage point change in assumed health care cost trend rates for 2012 would have

the following effects:

1% increase 1% decrease

(in millions)

Effect on postretirement obligation ................................ $9 $(7)

The effect on total service and interest cost components would be less than $1 million.

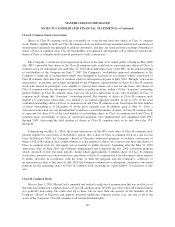

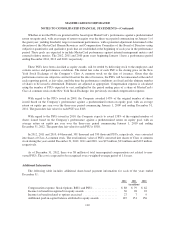

The Company’s discount rate assumptions are based on a yield curve derived from high quality corporate

bonds, which is matched to the expected cash flows to each of the respective Plans.

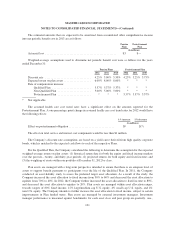

For the Qualified Plan, the Company considered the following to determine the assumption for the expected

weighted-average return on plan assets: (1) historical return data for both the equity and fixed income markets

over the past ten-, twenty- and thirty-year periods; (2) projected returns for both equity and fixed income; and

(3) the weighting of assets within our portfolio at December 31, 2012 by class.

Plan assets are managed with a long-term perspective intended to ensure that there is an adequate level of

assets to support benefit payments to participants over the life of the Qualified Plan. In 2011, the Company

conducted an asset-liability study to assess the preferred target asset allocation. As a result of the study, the

Company increased the asset allocation to fixed income from 30% to 60% and decreased the asset allocation to

equities from 70% to 40%. In 2012, the Company further increased the asset allocation to fixed income to 80%,

and decreased the asset allocation to equities to 20%. Plan assets are managed within asset allocation ranges,

towards targets of 80% fixed income, 12% large/medium cap U.S. equity, 4% small cap U.S. equity, and 4%

non-U.S. equity. The Company intends to further increase the asset allocation to fixed income, subject to certain

improvements in Plan funded status. Plan assets are managed by external investment managers. Investment

manager performance is measured against benchmarks for each asset class and peer group on quarterly, one-,

101