MasterCard 2012 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2012 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

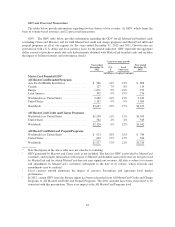

Processed Transactions. The table below sets forth the total number of transactions processed by

MasterCard for the years ended December 31, 2012 and 2011:

Year ended

December 31, 2012 Year-over-year growth

Year ended

December 31, 2011

(in millions, except percentages)

Processed Transactions ............ 34,156 25% 27,265

Participation Standards

We establish and enforce our standards surrounding participation in MasterCard and the use and acceptance

of cards carrying our brands.

Rulemaking and Application of Standards

Participation in the MasterCard payments network is generally open to financial institutions and other

entities that are our customers. Applicants for participation must meet specified requirements. In general, we

grant licenses by territory to applicants that meet those specified criteria. Licenses provide customers with certain

rights, including access to the network and usage of our brands. Anti-money laundering due diligence reviews

and customer risk management reviews are conducted on all new customers prior to issuing a license and

existing customers are evaluated applying a risk-based approach. All customers must meet the requirements of

our anti-money laundering program, and we can suspend and ultimately terminate participation for non-

compliance with the program. As a condition of our licenses, customers agree to comply with our standards,

which include requirements in our certificate of incorporation, bylaws, policies, rules and operating regulations

and procedures. MasterCard and certain of our affiliates are the governing bodies that establish and apply our

standards, which relate to topics such as participation eligibility and financial soundness criteria; the standards,

design and features of cards and card programs; the use of our trademarks; merchant acquiring activities

(including acceptance standards applicable to merchants); and guaranteed settlement and customer failures.

Customer Risk Management

We guarantee the settlement of many of the transactions between our issuers and acquirers to ensure the

integrity of our network (“settlement exposure”). We do not, however, guarantee payments to merchants by their

acquirer, or the availability of unspent prepaid cardholder balances held by the issuer. As a guarantor of certain

obligations of principal customers, we are exposed to customer credit risk arising from the potential financial

failure of any principal customers of MasterCard, Maestro and Cirrus, and affiliate debit licensees. Our gross

settlement exposure for MasterCard, Maestro and Cirrus-branded transactions, which is primarily estimated using

the average daily card volume during the quarter multiplied by the estimated number of days to settle, was

approximately $38 billion as of December 31, 2012. Principal customers participate directly in MasterCard

programs and are responsible for the settlement and other activities of their sponsored affiliate customers.

To minimize the contingent risk to MasterCard of a failure of a customer to meet its settlement obligations,

we monitor the financial health of, economic and political operating environments of, and compliance with our

standards by, our principal customers, affiliate debit licensees and other entities to which we grant licenses. If the

financial condition of a customer or the state of the economy or political environment in which it operates

indicates that it may not be able to satisfy its obligations to us or to our customers, or its payment obligations to

MasterCard merchants, or its obligations to safeguard funds for prepaid cardholders, we may require the

customer to make operational changes and/or post collateral. This collateral is typically in the form of a standby

letter of credit, a bank guarantee or a secured cash account and is required to mitigate our exposure. As of

December 31, 2012, we had customers who had posted approximately $3.8 billion in collateral held for

settlement exposure. If a customer becomes unable or unwilling to meet its obligations to us or other customers,

we are able to draw upon such customer’s collateral, if provided, in order to minimize any potential loss to

19