MasterCard 2012 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2012 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Our ability to grow is based on three drivers:

• personal consumption expenditure growth;

• the trend within the global payments industry away from paper-based forms of payment, such as cash

and checks, toward electronic forms of payment (such as those made via payment cards and other

devices); and

• our share in electronic payments through innovative solutions and new technology.

We support our focus on these drivers by continuing to:

• grow our core businesses globally, including credit, debit, prepaid and commercial programs and

solutions, as well as the processing of payment transactions over the MasterCard Worldwide Network,

• diversify our business by seeking new areas of growth in markets around the world, expanding points of

acceptance globally, seeking to maintain unsurpassed acceptance, and deepening existing relationships

or entering into new relationships with payments industry participants, such as merchants, governments

and telecommunications companies, and

• build new businesses through technology and continued strategic efforts and alliances focused on

innovative payment methods like e-commerce and mobile.

We operate in a dynamic and rapidly evolving legal and regulatory environment. In recent years, we have

faced heightened regulatory and legislative scrutiny and other legal challenges, particularly with respect to

interchange fees. Interchange fees balance payments system costs among acquirers and issuers (and in turn,

among merchants and cardholders). These fees, however, have been the subject of regulatory review and

challenges and legislative action, as well as litigation, as electronic forms of payment have become relatively

more important to local economies. Although we establish certain interchange rates and collect and remit

interchange fees on behalf of our customers, we do not earn revenues from interchange fees. See “Risk Factors-

Legal and Regulatory Risks” in Part I, Item 1A of this Report.

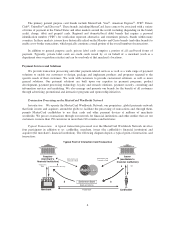

The Global Payments Industry

We operate in the global payments industry, which consists of all forms of payment including:

• Paper-based payments—cash, personal checks, money orders, official checks, travelers cheques and

other paper-based means of transferring value;

• Card-based payments—credit cards, charge cards, debit and deferred debit cards (including cash access

or Automated Teller Machine (“ATM”) cards), prepaid cards and other types of cards;

• Contactless, mobile and web-based payments—contactless payments, electronic payments through

mobile phones and other handheld devices using a variety of applications, and e-commerce transactions

on the Internet and through web browsers; and

• Other electronic payments—wire transfers, electronic benefits transfers, bill payments and automated

clearing house payments, among others.

The most common card-based forms of payment are general purpose cards, which are payment cards

carrying logos that permit widespread use of the cards within countries, regions or around the world. General

purpose cards have different attributes depending on the type of accounts to which they are linked:

• credit or charge cards typically access a credit account that either requires payment of the full balance

within a specified period (a charge card) or that permits the cardholder to carry a balance in a revolving

credit account (a credit card);

• debit cards typically access a deposit account or other account with accessible funds maintained by the

cardholder; and

• prepaid cards typically access previously-funded monetary value.

5