MasterCard 2012 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2012 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MASTERCARD INCORPORATED

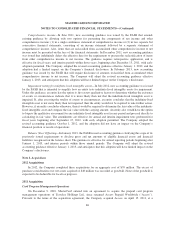

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

presented these funds as restricted cash since the use of the funds under the qualified settlement fund is restricted

for payment under the preliminary settlement agreement. Subject to court approval, all or a portion of the funds

would be returned to the Company in the event that the settlement is not finalized or certain merchants opt out of

the settlement agreement. See Note 5 (Fair Value and Investment Securities), Note 10 (Accrued Expenses) and

Note 18 (Legal and Regulatory Proceedings) for further detail.

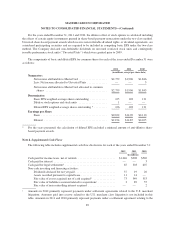

Fair value—The Company measures certain financial assets and liabilities at fair value on a recurring basis

by estimating the price that would be received to sell an asset or paid to transfer a liability in an orderly

transaction between market participants at the measurement date. The Company classifies these recurring fair

value measurements into a three-level hierarchy (“Valuation Hierarchy”) and discloses the significant

assumptions utilized in measuring all of its assets and liabilities at fair value.

The Valuation Hierarchy is based upon the transparency of inputs to the valuation of an asset or liability as

of the measurement date. A financial instrument’s categorization within the Valuation Hierarchy is based upon

the lowest level of input that is significant to the fair value measurement. The three levels of the Valuation

Hierarchy are as follows:

• Level 1—inputs to the valuation methodology are quoted prices (unadjusted) for identical assets or

liabilities in active markets.

• Level 2—inputs to the valuation methodology include quoted prices for similar assets and liabilities in

active markets, quoted prices for identical assets and liabilities in inactive markets and inputs that are

observable for the asset or liability, either directly or indirectly, for substantially the full term of the

financial instrument.

• Level 3—inputs to the valuation methodology are unobservable and significant to the fair value

measurement.

Certain assets and liabilities are measured at fair value on a nonrecurring basis. The Company’s assets and liabilities

measured at fair value on a nonrecurring basis include property, plant and equipment, nonmarketable equity investments,

goodwill and other intangible assets. These assets are not measured at fair value on an ongoing basis; however, they are

subject to fair value adjustments in certain circumstances, such as when there is evidence of impairment.

The valuation methods for goodwill and other intangible assets involve assumptions concerning comparable

company multiples, discount rates, growth projections and other assumptions of future business conditions. The

Company performs a qualitative analysis to first determine whether the existence of events or circumstances

indicate that it is more likely than not that goodwill and indefinite-lived intangible assets are impaired. If, after

assessing the totality of events or circumstances, the Company concludes that it is not more likely than not that

goodwill and indefinite-lived intangible assets are impaired, then the Company is not required to take further

action. However, if the Company concludes otherwise, then it is required to determine the fair value of goodwill

and indefinite-lived intangible assets and compare the fair value with the carrying amount. As the assumptions

employed to measure these assets and liabilities on a nonrecurring basis are based on management’s judgment

using internal and external data, these fair value determinations are classified in Level 3 of the Valuation

Hierarchy. See Note 5 (Fair Value and Investment Securities) for information about methods and assumptions.

The Company has not elected to apply the fair value option to its eligible financial assets and liabilities.

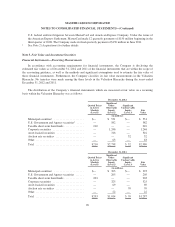

Investment securities—The Company classifies investments in debt securities as held-to-maturity or

available-for-sale and classifies investments in equity securities as available-for-sale or trading, if a readily

available fair value can be determined. Available-for-sale securities that are available to meet the Company’s

current operational needs are classified as current assets. Available-for-sale securities that are not available to

meet the Company’s current operational needs are classified as non-current assets.

82