MasterCard 2012 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2012 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

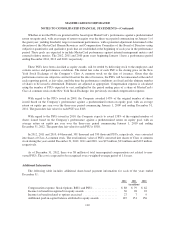

In February 2011, MasterCard and MasterCard International Incorporated entered into each of: (1) an

omnibus judgment sharing and settlement sharing agreement with Visa Inc., Visa U.S.A. Inc. and Visa

International Service Association and a number of customer financial institutions; and (2) a MasterCard

settlement and judgment sharing agreement with a number of customer financial institutions. The agreements

provide for the apportionment of certain costs and liabilities which MasterCard, the Visa parties and the customer

financial institutions may incur, jointly and/or severally, in the event of an adverse judgment or settlement of one

or all of the cases in the interchange merchant litigations. Among a number of scenarios addressed by the

agreements, in the event of a global settlement involving the Visa parties, the customer financial institutions and

MasterCard, MasterCard would pay 12% of the monetary portion of the settlement. In the event of a settlement

involving only MasterCard and the customer financial institutions with respect to their issuance of MasterCard

cards, MasterCard would pay 36% of the monetary portion of such settlement.

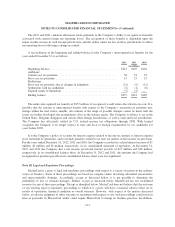

On July 13, 2012, MasterCard entered into a Memorandum of Understanding (“MOU”) to settle the

merchant class litigation, and separately agreed in principle to settle all claims brought by the individual

merchant plaintiffs. The MOU sets out a binding obligation to enter into a settlement agreement, and is subject

to: (1) the successful completion of certain appendices, (2) the successful negotiation of a settlement agreement

with the individual merchant plaintiffs, (3) final court approval of the class settlement, and (4) any necessary

internal approvals for the parties. MasterCard’s financial portion of the settlements is estimated to total $790

million on a pre-tax basis. Of that total, MasterCard recorded a pre-tax charge of $770 million in the fourth

quarter of 2011 and an additional $20 million pre-tax charge in the second quarter of 2012. In addition to the

financial portion of the settlement, U.S. merchant class members would also receive a 10 basis point reduction in

default credit interchange fees for a period of eight months, funded by a corresponding reduction in the default

credit interchange fees paid by acquirers to issuers. MasterCard would also be required to modify its No

Surcharge Rule to permit U.S. merchants to surcharge MasterCard credit cards, subject to certain limitations set

forth in the class settlement agreement. On October 19, 2012, the parties entered into a definitive settlement

agreement with respect to the merchant class litigation (consistent with the terms of the MOU), and separately

also entered into a settlement agreement with the individual merchant plaintiffs. The merchant class litigation

settlement agreement is subject to court approval. The parties to the merchant class litigation filed a motion

seeking preliminary approval of the settlement on October 19, 2012, and the court granted preliminary approval

of the settlement on November 27, 2012 and scheduled a final approval hearing for September 2013. In 2012, the

Company paid $790 million with respect to the settlements, of which $726 million was paid into a qualified

settlement fund related to the merchant class litigations. Rule practice changes required by the settlement were

implemented in late January 2013. In the event that the merchant class litigation settlement agreement is not

approved by the court, or if the class settlement agreement is otherwise terminated by the defendants pursuant to

the conditions in the settlement agreement and the litigations are not settled, a negative outcome in the litigation

could have a material adverse effect on MasterCard’s results of operations, financial position and cash flows.

Canada. In December 2010, the Canadian Competition Bureau (the “CCB”) filed an application with the

Canadian Competition Tribunal to strike down certain MasterCard rules related to point-of-sale acceptance,

including the “honor all cards” and “no surcharge” rules. The hearing on the matter was held before the Canadian

Competition Tribunal and was completed in June 2012. The parties are awaiting a decision from the Canadian

Competition Tribunal. In December 2010, a complaint styled as a class action lawsuit was commenced against

MasterCard in Quebec on behalf of Canadian merchants. That suit essentially repeated the allegations and

arguments of the CCB application to the Canadian Competition Tribunal and sought compensatory and punitive

damages in unspecified amounts, as well as injunctive relief. In March 2011, a second purported class action

lawsuit was commenced in British Columbia against MasterCard, Visa and a number of large Canadian financial

institutions, and in May 2011 a third purported class action lawsuit was commenced in Ontario against the same

defendants. These suits allege that MasterCard, Visa and the financial institutions have engaged in a conspiracy

118