MasterCard 2012 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2012 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

Pursuant to the requirements of the Pension Protection Act of 2006, the Company did not have a mandatory

contribution to the Qualified Plan in 2012, 2011 or 2010. However, the Company did make voluntary

contributions of $10 million, $20 million and $20 million to the Qualified Plan in 2012, 2011 and 2010,

respectively. The Company is not required to contribute to the Qualified Plan in 2013 and does not intend to

make a contribution in 2013. The Company does not make any contributions to the Non-qualified Plan or to its

Postretirement Plan other than funding benefit payments.

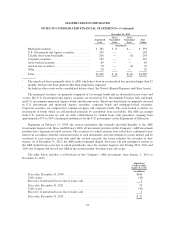

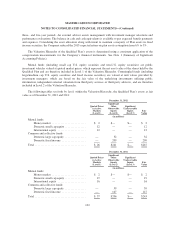

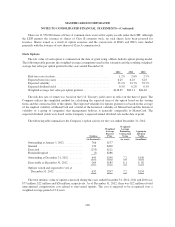

The following table summarizes expected benefit payments through 2022 for the Pension Plans and the

Postretirement Plan, including those payments expected to be paid from the Company’s general assets. Since the

majority of the benefit payments for the Pension Plans are made in the form of lump-sum distributions, actual

benefit payments may differ from expected benefit payments.

Postretirement Plan

Pension

Plans

Benefit

Payments

Expected

Subsidy

Receipts

Net

Benefit

Payments

(in millions)

2013 .......................................... $23 $ 4 $— $ 4

2014 .......................................... 21 4 — 4

2015 .......................................... 21 4 — 4

2016 .......................................... 19 4 — 4

2017 .......................................... 19 5 — 5

2018—2022 .................................... 95 25 1 24

Savings Plan

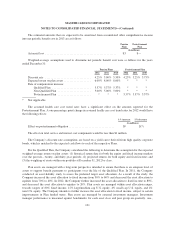

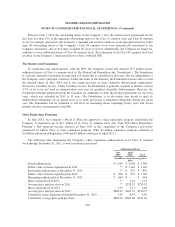

Substantially all of the Company’s U.S. employees are eligible to participate in a defined contribution

savings plan (the “Savings Plan”) sponsored by the Company. The Savings Plan allows employees to contribute a

portion of their base compensation on a pre-tax and after-tax basis in accordance with specified guidelines. The

Company matches a percentage of employees’ contributions up to certain limits. In addition, the Company has

several defined contribution plans outside of the United States. The Company’s contribution expense related to

all of its defined contribution plans was $41 million, $35 million and $33 million for 2012, 2011 and 2010,

respectively.

Severance Plan

The Company provides limited postemployment benefits to eligible former U.S. employees, primarily

severance under a formal severance plan (the “Severance Plan”). The Company accounts for severance expense

by accruing the expected cost of the severance benefits expected to be provided to former employees after

employment over their relevant service periods. The Company updates the assumptions in determining the

severance accrual by evaluating the actual severance activity and long-term trends underlying the assumptions.

As a result of updating the assumptions, the Company recorded adjustments to severance expense related to the

Severance Plan which reduced severance expense by $5 million in 2012 and increased the expense by $1 million

and $3 million in 2011 and 2010, respectively. These amounts were part of total severance expense of

$29 million, $23 million and $39 million in 2012, 2011 and 2010, respectively, included in general and

administrative expenses in the accompanying consolidated statement of operations.

103