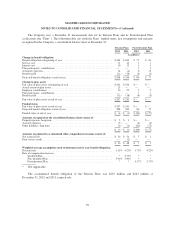

MasterCard 2012 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2012 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

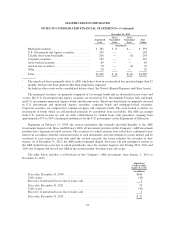

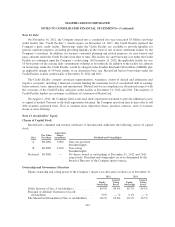

During 2012, the Company acquired three businesses and recognized $48 million of related goodwill. On

April 15, 2011, MasterCard acquired Access. The Company recognized $354 million of related goodwill as part

of the acquisition of Access. See Note 2 (Acquisitions) for further details. The Company had no accumulated

impairment losses for goodwill at December 31, 2012 or 2011. Based on annual impairment testing, the

Company’s reporting unit is not at significant risk of goodwill impairment.

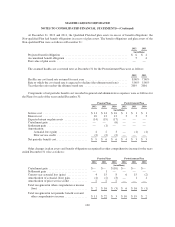

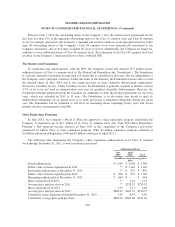

Note 9. Other Intangible Assets

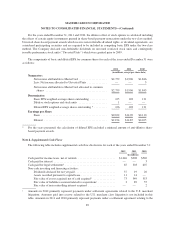

The following table sets forth net intangible assets, other than goodwill, at December 31:

2012 2011

Gross

Carrying

Amount

Accumulated

Amortization

Net

Carrying

Amount

Gross

Carrying

Amount

Accumulated

Amortization

Net

Carrying

Amount

(in millions)

Amortized intangible assets:

Capitalized software ......... $ 786 $(506) $280 $ 765 $(502) $263

Trademarks and tradenames . . . 48 (31) 17 46 (26) 20

Customer relationships ....... 230 (54) 176 218 (26) 192

Other ..................... 11 (5) 6 4 (3) 1

Total ......................... 1,075 (596) 479 1,033 (557) 476

Unamortized intangible assets:

Customer relationships ....... 193 — 193 189 — 189

Total ......................... $1,268 $(596) $672 $1,222 $(557) $665

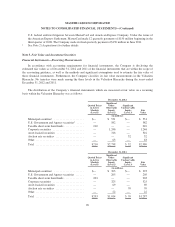

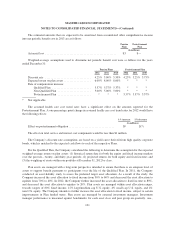

Additions to capitalized software in 2012 primarily related to internally developed software, purchased software

and acquisitions. Additions to capitalized software in 2011 primarily related to internally developed software and the

acquisition of Access in 2011. See Note 2 (Acquisitions) for further details. Certain intangible assets, including

amortizable and unamortizable customer relationships and trademarks and tradenames, are denominated in foreign

currencies. As such, the change in intangible assets includes a component attributable to foreign currency translation.

Amortization and impairment expense on the assets above amounted to $149 million, $118 million and

$80 million in 2012, 2011 and 2010, respectively. The following table sets forth the estimated future amortization

expense on amortizable intangible assets on the balance sheet at December 31, 2012 for the years ending December 31:

(in millions)

2013 .................................................................... $150

2014 .................................................................... 128

2015 .................................................................... 87

2016 .................................................................... 34

2017 and thereafter ........................................................ 80

$479

97