MasterCard 2012 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2012 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

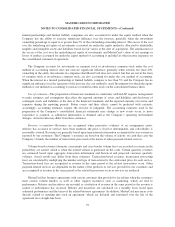

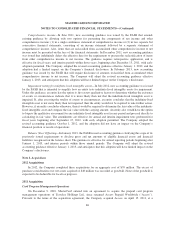

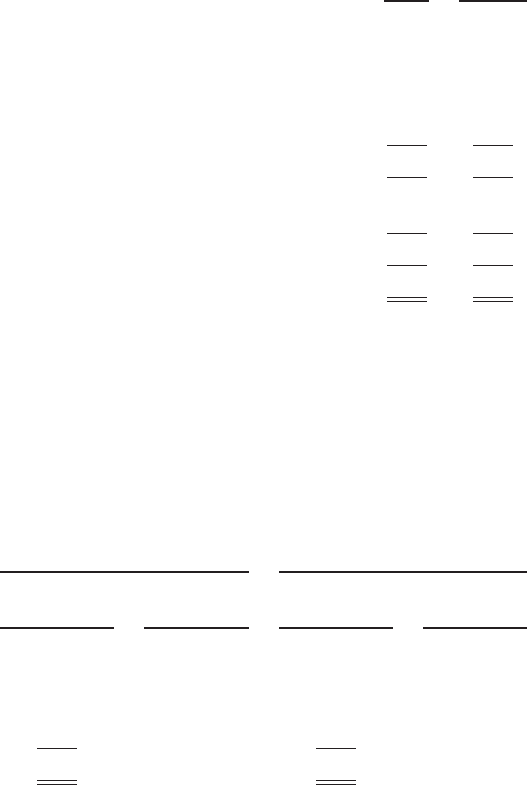

Balance Sheet Impact of Significant Acquisitions

The following table summarizes the purchase price allocations for the Access and DataCash acquisitions as

of April 15, 2011 and October 22, 2010, respectively:

Access DataCash

(in millions)

Current assets ...................................................... $ 50 $ 48

Property, plant and equipment ......................................... 2 3

Intangible assets .................................................... 164 129

Goodwill .......................................................... 354 402

Other assets ........................................................ — 7

Total assets acquired ............................................. 570 589

Current liabilities ................................................... (56) (24)

Non-current liabilities ................................................ (33) (31)

Total liabilities assumed .......................................... (89) (55)

Net assets acquired .............................................. $481 $534

Purchase consideration has been allocated to the tangible and identifiable intangible assets and to liabilities

assumed based on their respective fair values on the acquisition date. The excess of purchase consideration over

net assets acquired was recorded as goodwill. The amount of goodwill expected to be deductible for local tax

purposes is not significant.

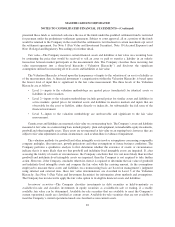

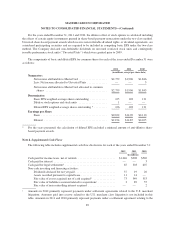

Intangible assets consist of developed technologies, customer relationships, tradenames and non-compete

agreements, which have useful lives ranging from 1 to 10 years. See Note 9 (Other Intangible Assets). The

following table summarizes the fair value of the acquired intangible assets for the Access and DataCash

acquisitions as of April 15, 2011 and October 22, 2010, respectively:

Access DataCash

Intangible Asset

Fair Values at

Acquisition Date

Weighted-

Average Useful

Life

Intangible Asset

Fair Values at

Acquisition Date

Weighted-

Average Useful

Life

(in millions) (in years) (in millions) (in years)

Customer relationships ........ $132 8 $ 74 7

Developed technologies ........ 17 4 42 5

Tradenames ................. 15 6 11 5

Non-compete agreements ...... — 2 1

Total intangible assets ......... $164 $129

Pro forma information related to acquisitions was not included because the impact on the Company’s

consolidated results of operations was not considered to be material.

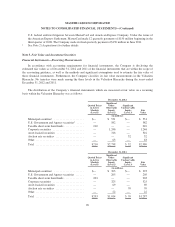

Note 3. Earnings Per Share

Basic earnings per share (“EPS”) for the year ended December 31, 2012 is calculated by dividing net

income attributable to MasterCard by the weighted-average number of common shares outstanding during the

year. Diluted EPS is calculated by dividing net income attributable to MasterCard by the weighted-average

number of common shares outstanding during the year, adjusted for the potentially dilutive effect of stock

options and unvested stock units using the treasury stock method.

88