MasterCard 2012 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2012 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MASTERCARD INCORPORATED

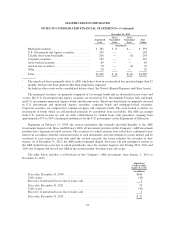

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

purchase price of 295 million U.K. pound sterling, or $481 million, including adjustments for working capital,

and contingent consideration (an “earn-out”) of up to an additional 35 million U.K. pound sterling, or

approximately $57 million, based on full year 2011 revenues. The Company recognized a current liability related

to the earn-out of 6 million U.K. pound sterling, or approximately $9 million. The fair value of the earn-out

arrangement was estimated by applying a probability-weighted income approach. The full year revenues for 2011

did not meet the requirements for payment of the earn-out and therefore the liability was eliminated and the

Company recorded other income of $9 million in 2011.

Access manages and delivers consumer and corporate prepaid travel cards through business partners around

the world, including financial institutions, retailers, travel agents and foreign exchange bureaus. The acquisition

of Access enables the Company to offer end-to-end prepaid card solutions encompassing branded switching,

issuer processing, and program management services, primarily focused on the travel sector and in markets

outside the United States.

In connection with the acquisition, the Company recognized $6 million of acquisition-related expenses,

which consisted primarily of professional fees related to completing the transaction. The Company recognized $2

million and $4 million during the years ended December 31, 2011 and 2010, respectively. These amounts were

included in general and administrative expenses. The consolidated financial statements include the operating

results of Access from the date of the acquisition.

2010 Acquisition

DataCash Group plc

On August 19, 2010, MasterCard entered into an agreement to acquire all the outstanding shares of

DataCash Group plc (“DataCash”), a European payment service provider. Pursuant to the terms of the acquisition

agreement, the Company acquired DataCash on October 22, 2010 at a purchase price of 334 million U.K. pound

sterling, or $534 million. There was no contingent consideration related to the acquisition.

DataCash provides e-commerce merchants with the ability to process secure payments across the world.

DataCash develops and provides outsourced electronic payments solutions, fraud prevention, alternative payment

options, back-office reconciliation and solutions for merchants selling via multiple channels. The acquisition of

DataCash creates a long-term growth platform in the e-commerce category while enhancing existing MasterCard

payment products and expanding its global presence in the internet gateway business.

In connection with the acquisition, the Company recognized $7 million of acquisition-related expenses

during the year ended December 31, 2010, which consisted primarily of professional fees related to closing the

transaction. These amounts were included in general and administrative expenses. The consolidated financial

statements include the operating results of DataCash from the date of the acquisition.

87